Several of the Aurum funds have unrestricted share classes, which provide eligible investors with an exposure to new issues. In 2018, IPO P&L led to an outperformance of nearly 1% on some of the Aurum funds’ unrestricted share classes, compared to the equivalent restricted classes.

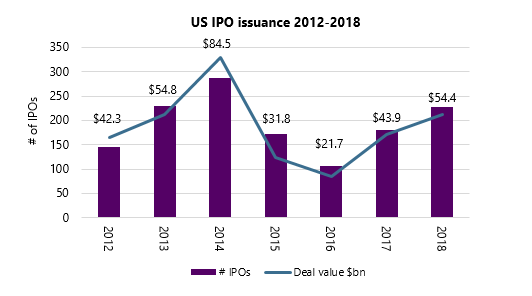

In 2018, Initial Public Offerings (“IPOs”) in the US had their busiest year by number and volume since 2014. According to PwC, by the end of 2018 over $54bn was raised in US IPOs, up 24% on 2017 and 2.5 times that of 2016.

Figure 1 Source: PwC Capital Markets Watch, IPO Scoop

Generally, IPOs are priced at a relatively low valuation to compensate investors for the assumed risk in investing in a previously private company. The IPO discounted price, compared against what would be considered fair value against listed peers, is such that the price tends to increase, sometimes significantly, on the first day. This increase in the offer price on day one of trading is sometimes referred to as the IPO “pop”.

Investment banks are incentivised for IPOs to go well. Often, as part of the agreement with the issuing company, they will contractually agree to undertake stabilisation action, over allot, issue additional shares and/or buy any unsold inventory of shares, in return for substantial fees.

If, during the book build, there is significant concern that an IPO will flop, steps are usually taken to reduce the risk of the poor publicity of a weak launch, as this can be hard for both the new public company and the advising bank to recover from. These steps include lowering the issue price of the shares, issuing fewer shares or cancelling the issuance entirely.