Embedded Impact report 2025

Growing and protecting environmental, social and financial capital

Aurum’s ESG approach

The Aurum group has always had a strong and committed approach to sustainability, both in the way we run our business and in our approach to social responsibility. You can download our ESG Policy here, and read about our Alternative ESG Symposium here.

Our purpose as a business is to grow and protect capital. Not only our clients’ capital, but also environmental capital; our planet and species and social capital; healthcare and education. We express this through Embedded Impact®.

What is Embedded Impact®?

Aurum is an Embedded Impact® business where donations are structured to proportionately increase as firm AUM increases. Donations are made to selected environmental and humanitarian charities.

This ensures that as we grow and prosper as a business, we are using this success to create meaningful, positive impact.

Aurum also offers two specific Embedded Impact® Funds where donations are made by Aurum from advisor fees.

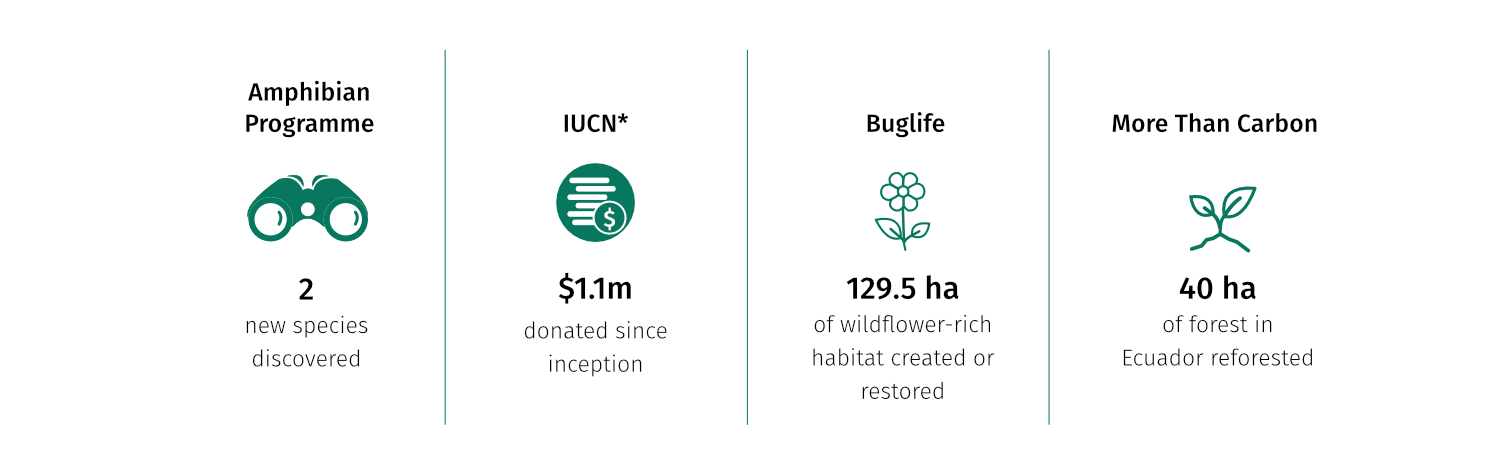

Environmental

Key stats:

Synchronicity Earth Amphibian Programme | Conservation

Synchronicity Earth Asian Species | Conservation

Synchronicity Earth Biocultural Diversity Programme | Conservation

Synchronicity Earth Congo Basin Programme | Conservation

Synchronicity Earth Freshwater Programme | Conservation

Synchronicity Earth Ocean Programme | Conservation

Synchronicity Earth SHOAL Partnership | Conservation

Africa Nature Investors Foundation | Conservation

Buglife | Conservation

International Union for Conservation of Nature | Conservation

IUCN | Conservation policy engagement

More Than Carbon | Alternative approach to carbon offsetting

More Than Carbon | Inspiring others

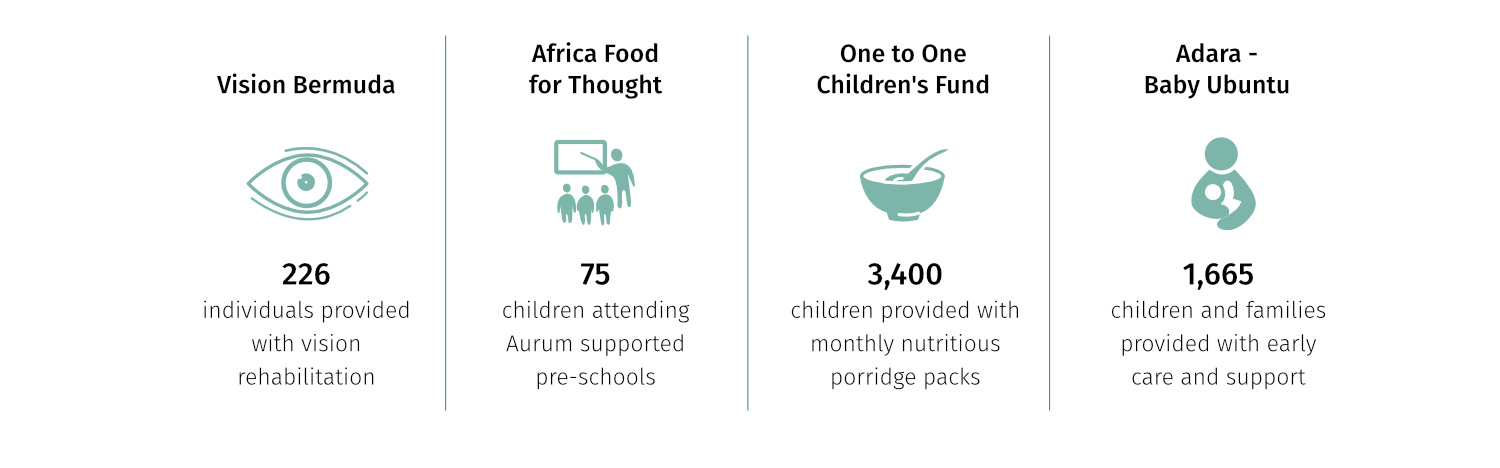

Humanitarian

Key stats:

Adara – Baby Ubuntu | Child protection and wellbeing

Africa Food for Thought | Child protection and wellbeing

Hope and Homes for Children | Child protection and wellbeing

One to One Children’s Fund | Child protection and wellbeing

Fair Play Playground | Disability and inclusion

Accessible Music and Theatre | Disability and inclusion

Sierra Leone Autistic Society | Disability and inclusion

Vision Bermuda | Disability and inclusion

Camp Simcha | Disability and inclusion

Essl Foundation | Disability and inclusion

Safe Passage | Refugee support

Choose Love | Refugee support

Mercy Ships | Life-changing healthcare provision

Medical Justice | Aiding persons in immigration detention

iheart | Cultivating mental health resilience

Aurum Bursary | Education and social mobility

Acumen | Changing the way the world tackles poverty

HelpFilm | Promoting philanthropic impact

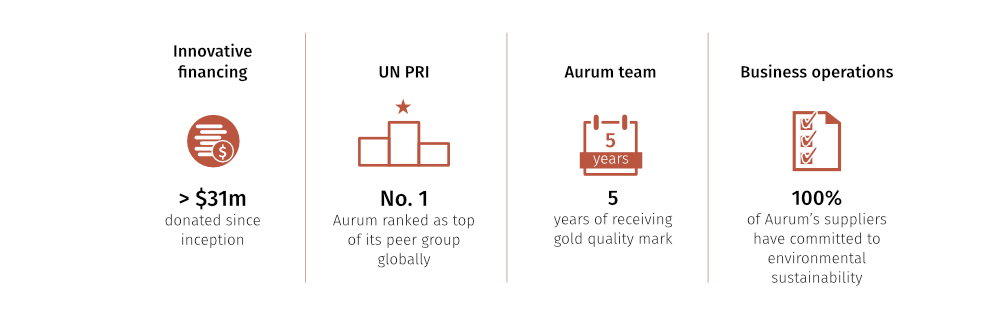

Engagement

Key stats:

Aurum Kaleidoscope Foundation | Innovative financing

Aurum Kaleidoscope Foundation | Innovative financing

Aurum Embedded Impact | Innovative financing

Mobilising the hedge fund industry | Advocacy and engagement

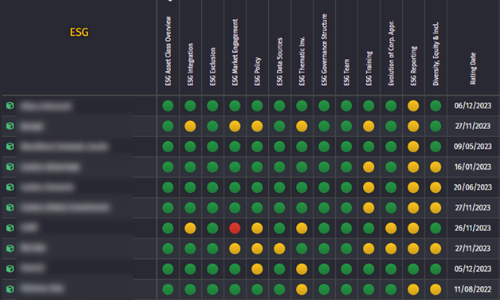

Manager data | Advocacy and engagement

Aurum team | Giving back

United Nations Principles for Responsible Investment | UN PRI

Cyber security | Reducing the risk

Task Force on Climate-related Financial Disclosures | TCFD

Business operations | Reducing our negative impact