Hedge Fund Data

Arbitrage strategy deep dive

26/11/2020

1 min read

12-month review to October 2020

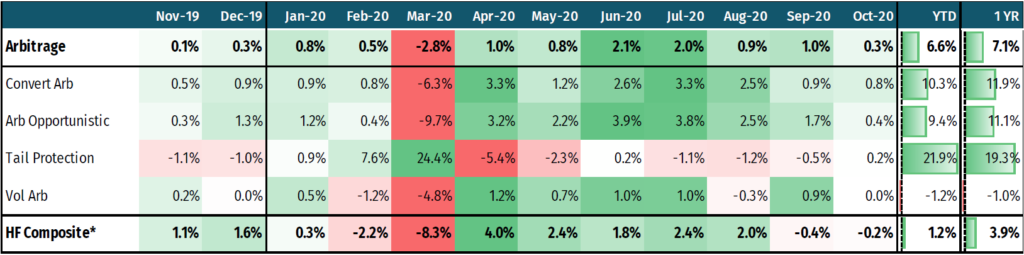

Arbitrage strategies generated an average return of 7.1% over the last 12 months; this figure is in line with the broader equity markets over the time period, but realising a fraction of the volatility, thus producing a significantly higher Sharpe, consistency, and with a more favourable drawdown profile.

Net Return of Master & Sub-Strategies