Hedge Fund Data

Event driven strategy deep dive

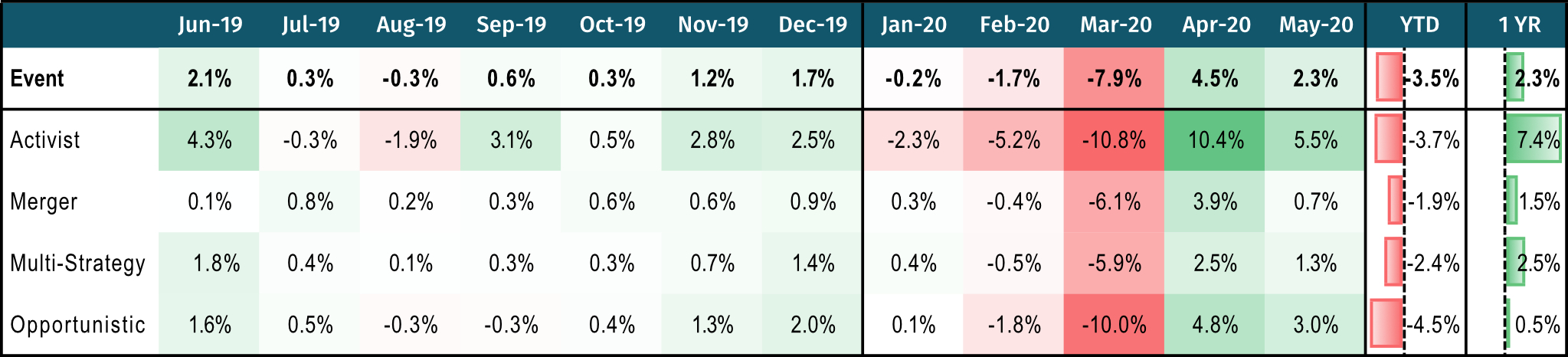

12 month review to May 2020

The Event Driven funds monitored by Aurum’s Hedge Fund Data Engine delivered an average asset-weighted net return of 2.3% in the 12 months to May 2020. The period can be thought of as a tale of two halves: the latter half of 2019 saw low volatility and generally positive returns across the space, whilst 2020 saw a spike in volatility and large performance dispersion across funds and by month. Despite all four Event Driven sub-strategies having negative performance year to date through to May, when looking across the last 12 months, all have delivered a positive absolute return. Over the 12 month period, the strongest performing sub-strategy was Activist, which returned 7.4%; the weakest was Event Opportunistic, which returned just 0.5%.