Hedge Fund Data

Hedge fund industry performance deep dive – Q1 2023

In summary…

- Global growth surprised markets positively in Q1 2023.

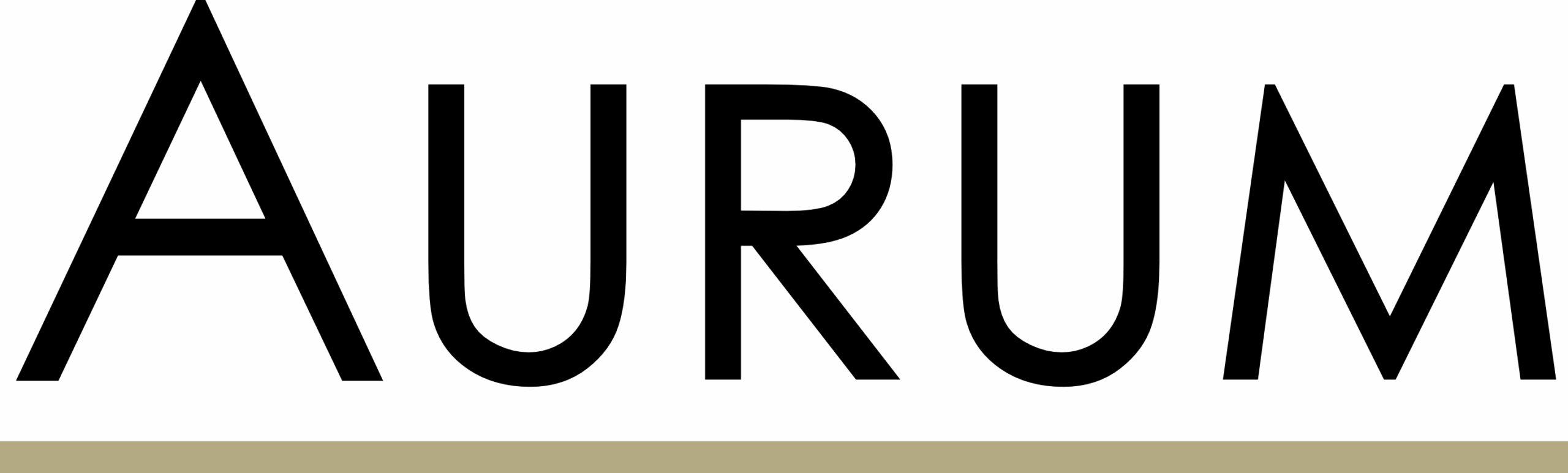

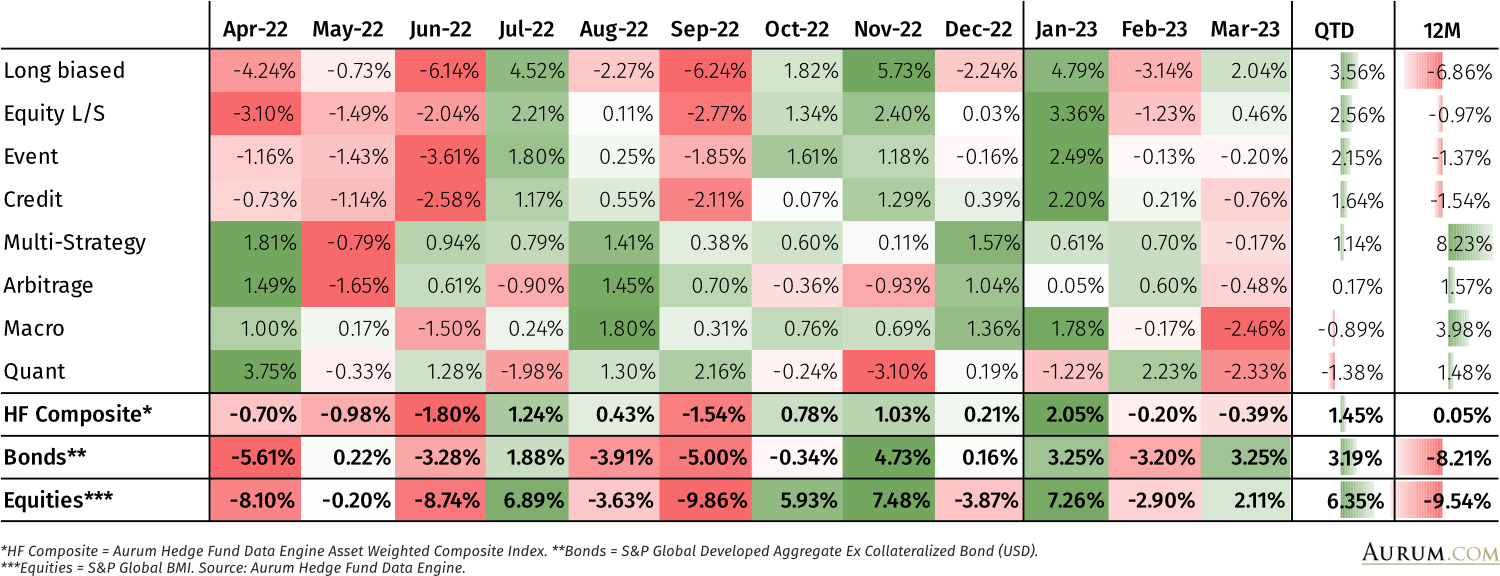

- Global equities*** and bonds** returned 6.35% and 3.19% respectively.

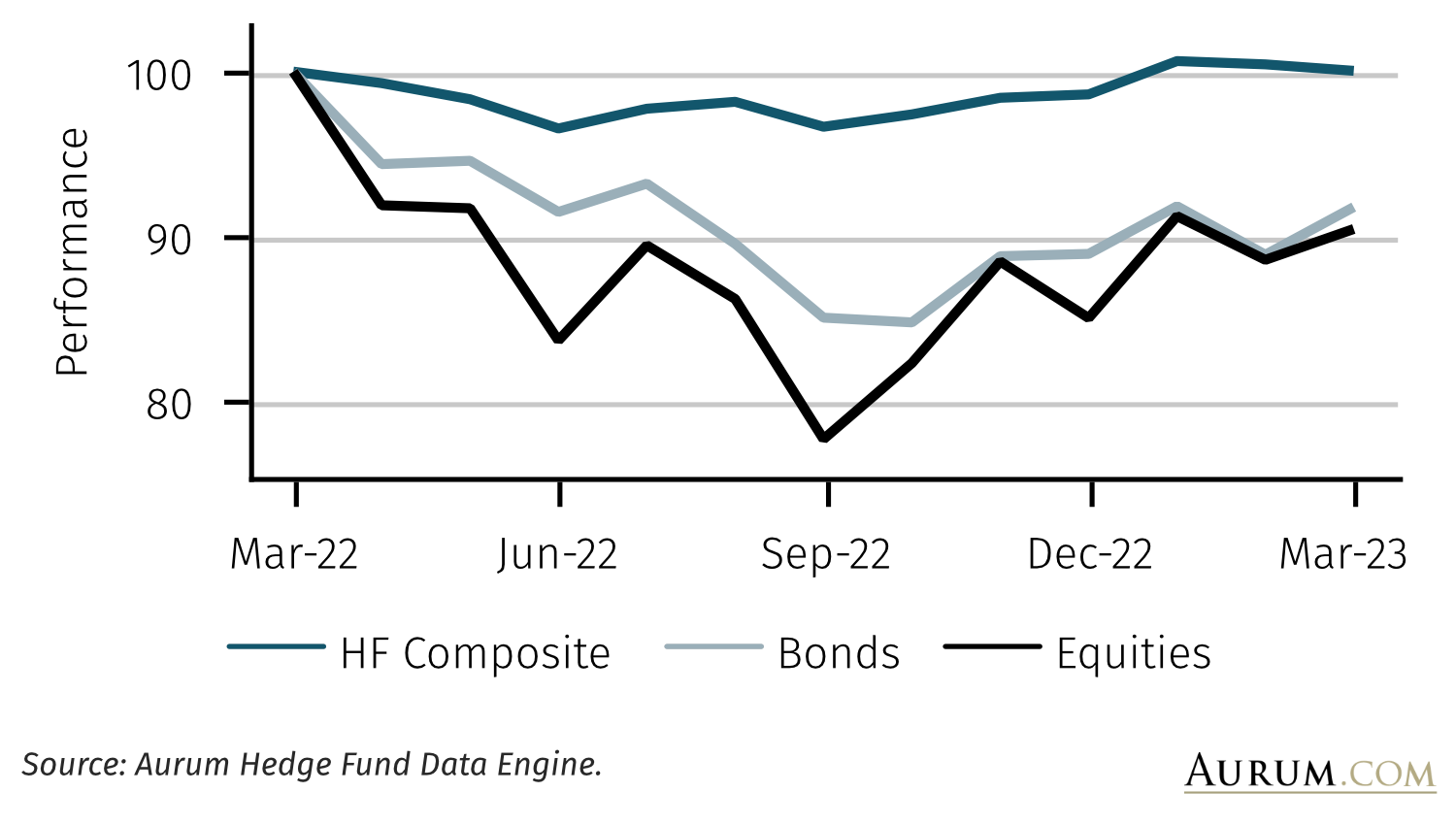

- Strategies with higher beta to equities outperformed more divergent strategies. Asset weighted average hedge fund return was 1.45% in Q1 2023.

- March was the standout month of poor performance with hedge funds down 0.39%, Macro (down 2.46%) and Quant (down 2.33%) being the biggest detractors.

- Interest rate moves resulting from several high-profile bank failures in March, had a significant impact on Macro strategies.

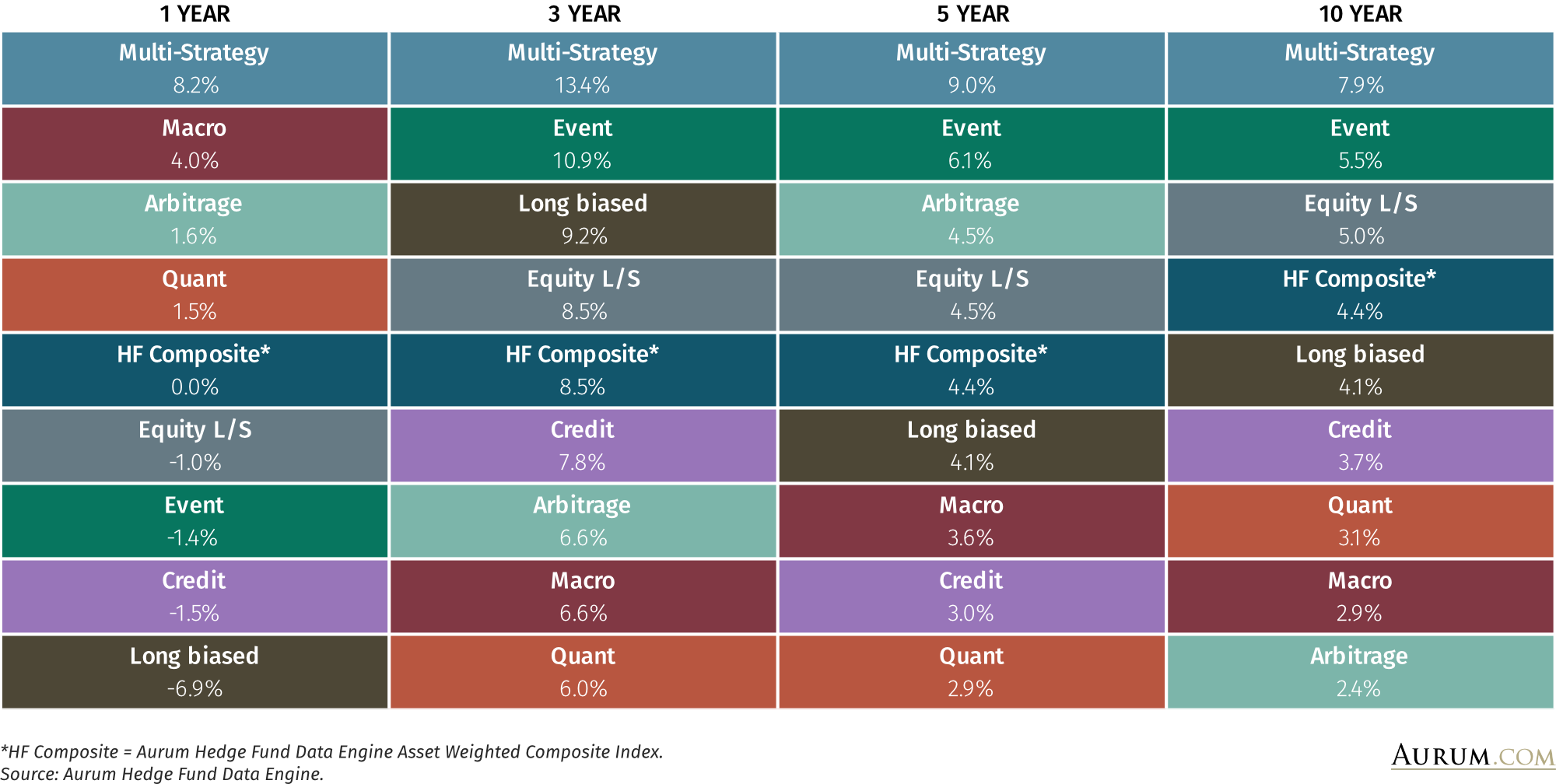

- 5 year CAR for hedge funds was at 4.42% at the end of the quarter, above bonds at -1.66% and just below equities at 4.49%.

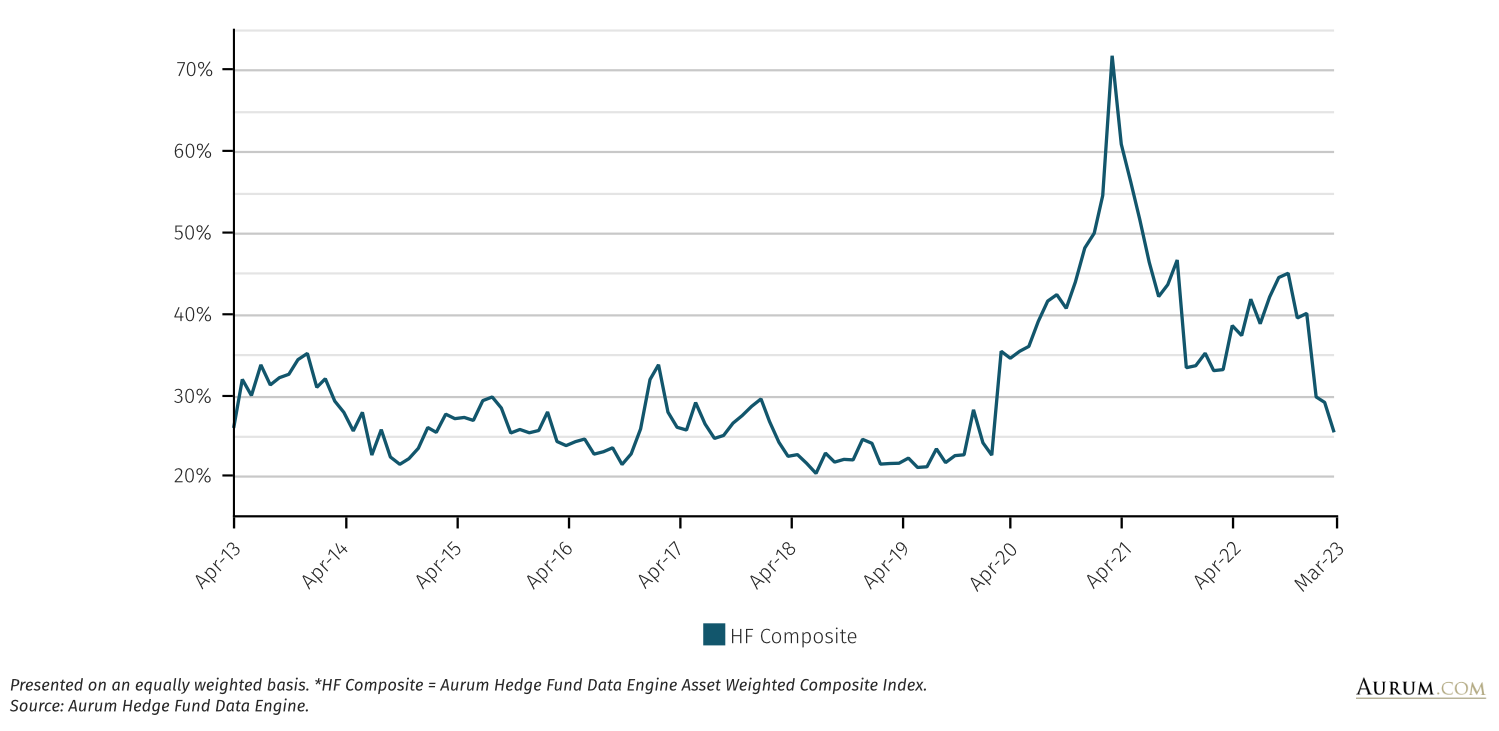

- Dispersion has fallen over the quarter returning closer to the observed long-term trend prior to 2020.

About Aurum

Aurum is an investment management firm focused on selecting hedge funds and managing fund of hedge fund portfolios for some of the world’s most sophisticated investors. Aurum also offers a range of single manager feeder funds.

Aurum’s portfolios are designed to grow and protect clients’ capital, while providing consistent uncorrelated returns. With 30 years of hedge fund investment experience, Aurum’s objective is to lower the barriers to entry enabling investors to access the world’s best hedge funds.

Aurum conducts extensive research and analysis on hedge funds and hedge fund industry trends. This research paper is designed to provide data and insights with the objective of helping investors to better understand hedge funds and their benefits.

HF COMPOSITE VS INDICES (1 YR)

NET RETURN (QTD)

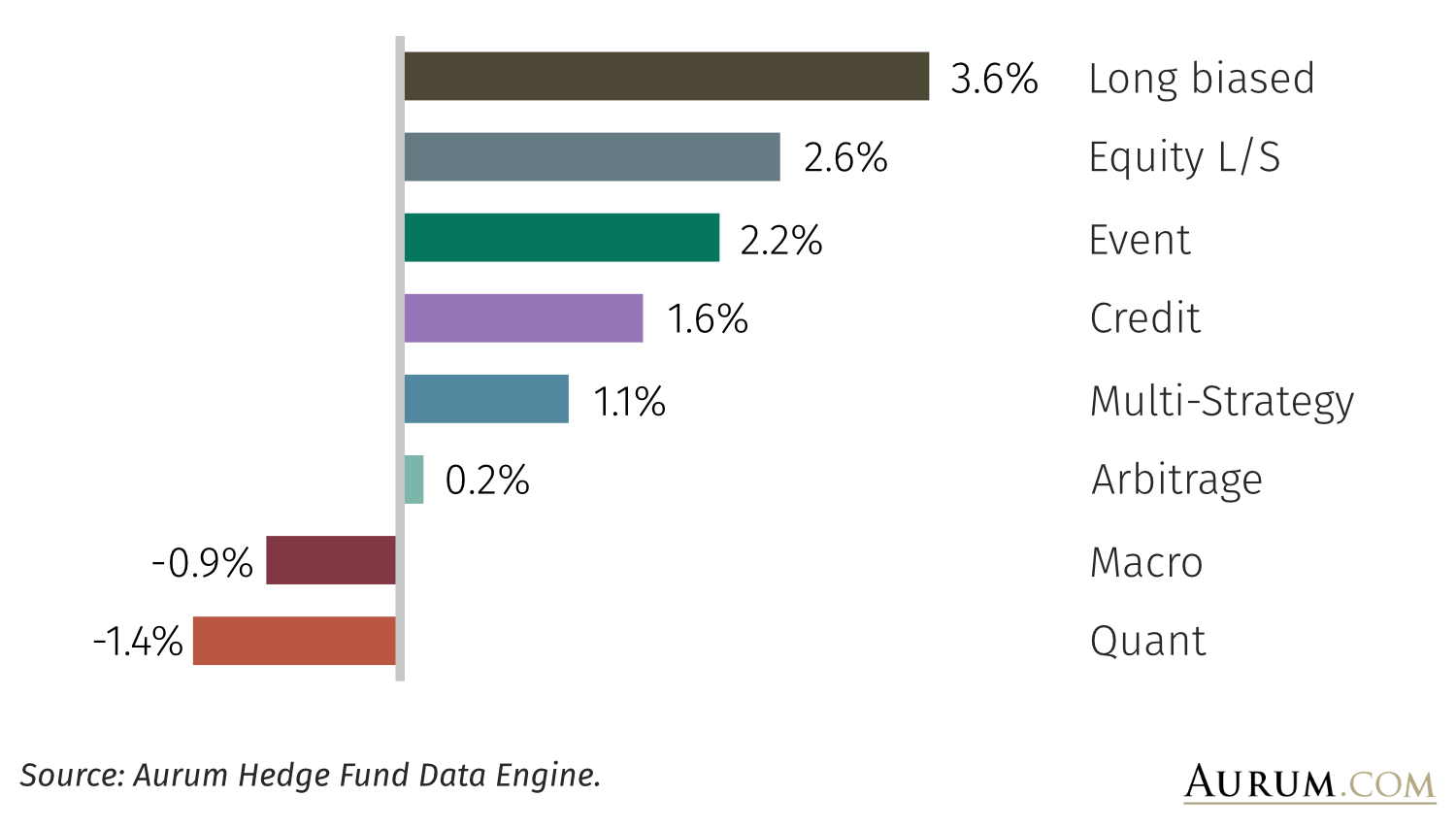

FUND COUNT – MARCH 23

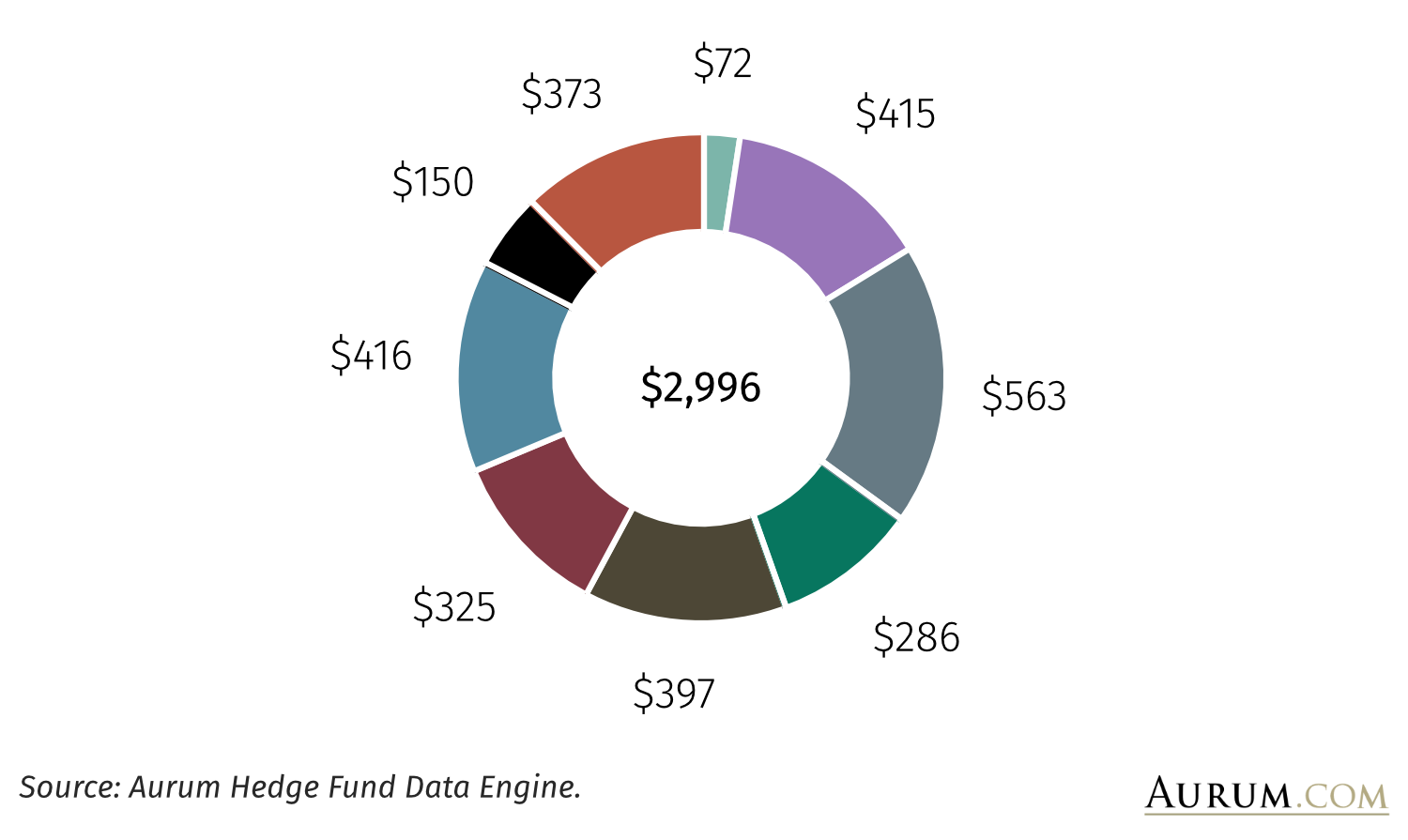

AUM ($BN) – MARCH 23

10th – 90th PERCENTILE 12M ROLLING PERFORMANCE SPREAD

NET RETURN (1 YR)

MASTER STRATEGY MULTIPLE PERIOD – HIERARCHICAL ANNUALISED NET RETURN TO MARCH 2023

The Hedge Fund Data Engine is a proprietary database maintained by Aurum Research Limited (“ARL”). For information on index methodology, weighting and composition please refer to https://www.aurum.com/aurum-strategy-engine/. For definitions on how the Strategies and Sub-Strategies are defined please refer to https://www.aurum.com/hedge-fund-strategy-definitions/

Bond and equity indices

The S&P Global BMI and S&P Global Developed Aggregate Ex Collateralized Bond (USD) Total Return Index (the “S&P Indices”) are products of S&P Dow Jones Indices LLC, its affiliates and/or their licensors and has been licensed for use by Aurum Research Limited. Copyright © 2021 S&P Dow Jones Indices LLC, its affiliates and/or their licensors. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC. For more information on any of S&P Dow Jones Indices LLC’s indices please visit www.spdji.com. S&P® is a registered trademark of Standard & Poor’s Financial Services LLC and Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC. Neither S&P Dow Jones Indices LLC, Dow Jones Trademark Holdings LLC, their affiliates nor their third party licensors make any representation or warranty, express or implied, as to the ability of any index to accurately represent the asset class or market sector that it purports to represent and neither S&P Dow Jones Indices LLC, Dow Jones Trademark Holdings LLC, their affiliates nor their third party licensors shall have any liability for any errors, omissions, or interruptions of any index or the data included therein. By accepting delivery of this Paper, the reader: (a) agrees it will not extract any index values from the Paper nor will it store, reproduce or further distribute the index values to any third party for any purpose in any format or by any means except that reader may store the Paper for its personal, non-commercial use; (b) acknowledges and agrees that S&P own the S&P Indices, the associated index values and all intellectual property therein and (c) S&P disclaims any and all warranties and representations with respect to the S&P Indices.