Hedge Fund Data

Macro strategy deep dive

31/07/2020

1 min read

12-month review to June 2020

There is no doubt that the 12-month period to June 2020 is amongst the most challenging and volatile trading environments that investors have witnessed, but it also created a number of compelling trading opportunities.

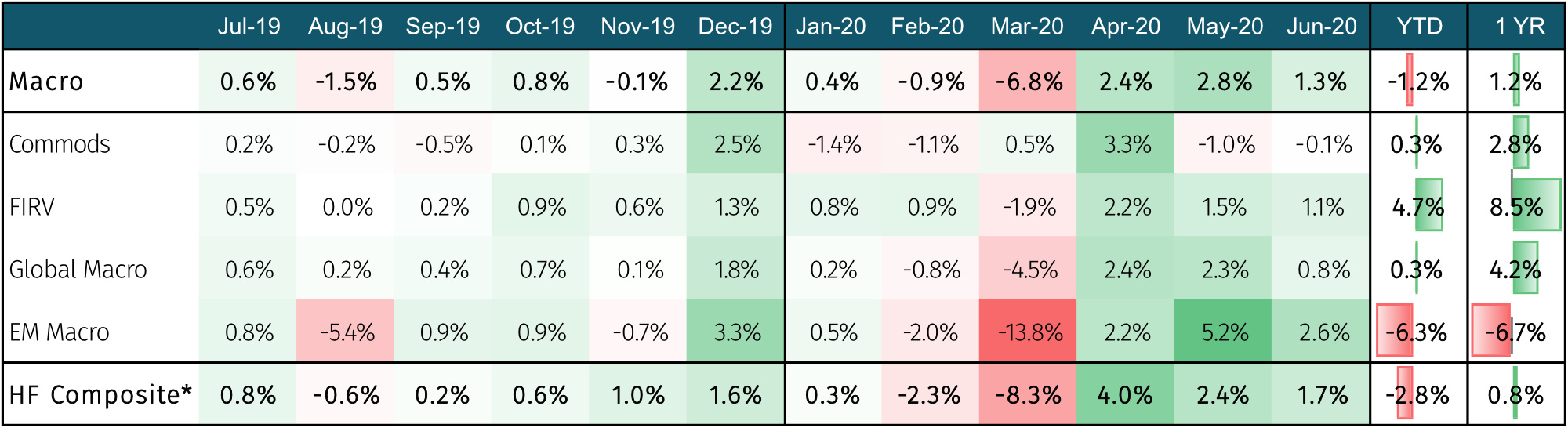

Against this backdrop, for the 12-month period to June 2020 the Macro hedge funds monitored by the Aurum Hedge Fund Data Engine delivered a net return of 1.2%, coming in above the Hedge Fund Composite Index*, which returned 0.8%, both on an asset-weighted basis. These headline numbers mask a huge amount of movement across the 12 months and significant performance dispersion across Macro sub-strategies.

Net Return of Master & Sub-Strategies