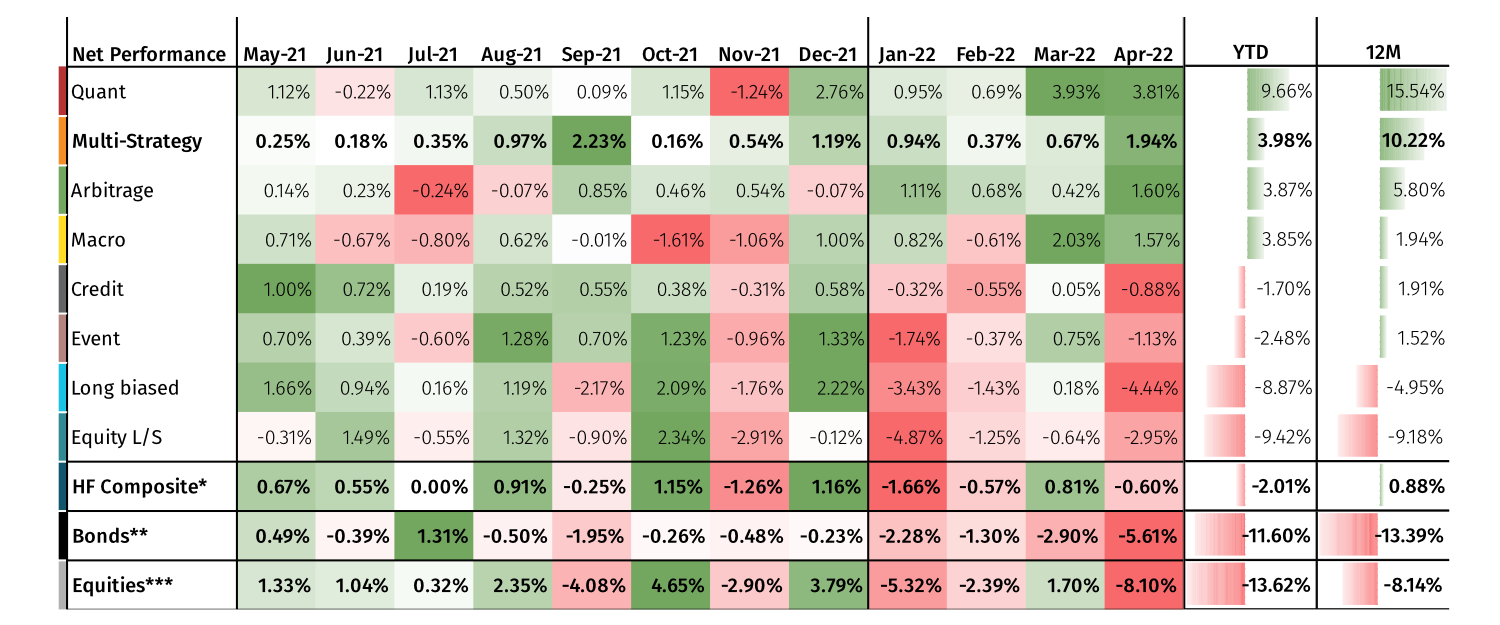

Hedge Fund Data

Multi-strategy deep dive – Apr 22

In summary…

- Multi-strategy funds posted 12 consecutive months of positive returns during a period that provided a number of significant challenges across the hedge fund universe.

- Multi-strategy is the second best performing strategy over the past 12 months and the best performing hedge fund strategy over 3, 5 and 10 year period.

- When decomposing multi-strategy returns by risk free rate, beta and alpha, the majority of the cumulative returns are shown to come from alpha.

- With the trend of larger managers tightening liquidity terms, those investors unable to accept the less liquid terms are likely to move down the curve in terms of manager quality and return expectations.

Overview

The past 12 months are an interesting period to review hedge fund performance, particularly for multi-strategy, which was the most consistent strategy during this period. Multi-strategy funds posted 12 consecutive months of positive returns during a period that provided a number of significant challenges across the wider hedge fund universe. The period under review encompassed the second year of the covid-19 pandemic, during which the roll-out of vaccine programs worldwide started to provide hope that economies and life in general would start to normalise. Then, in the beginning of 2022 we saw the breakout of a war in Ukraine, internationally imposed sanctions on Russia, a humanitarian crisis and major disruption to energy supplies, particularly in Europe.

Multi-strategy funds posted 12 consecutive months of positive returns during a period that provided a number of significant challenges across the hedge fund universe.

The early stages of the pandemic in 2020 saw drastic interest rate cuts, quantitative easing and massive fiscal stimulus packages. In somewhat of a reversal, the past year has been characterised by talk and anticipation of quantitative tapering, inflationary pressures and eventually interest rate hikes, which started in the very latter part of the period under review. Strategies that were in favour during 2020, were more benign in 2021 and visa-versa; however, multi-strategy funds appear to have been effective in both periods. While returns in the past 12 months were not as strong as the 12 months prior, they were still very respectable and much more consistent and controlled.

Multi-strategy is the second-best performing strategy over the past 12 months and the best performing hedge fund strategy over 3, 5 and 10 years. At the same time, it exhibits one of the lowest volatilities and achieves the highest Sharpe ratio benefitting from the funds’ highly diversified portfolios.

CUMULATIVE NET RETURN OF MASTER STRATEGIES (1 YR)

*HF Composite = Aurum Hedge Fund Data Engine Asset Weighted Composite Index. **Bonds = S&P Global Developed Aggregate Ex Collateralized Bond (USD). ***Equities = S&P Global BMI.