Hedge Fund Data

Is performance or asset gathering driving growth in hedge fund industry assets? And why does the answer matter to hedge fund investors?

In summary…

In the wake of recent market volatility, even more investors are seeking downside protection from hedge funds, resulting in large inflows into the hedge fund industry. But if we look back at the growth of hedge fund AUM over the past decade, where has the huge growth over the period come from?

- Hedge fund industry assets have grown by 63% in the past decade.

- When we look at the hedge fund industry in aggregate, the vast majority of this dollar growth has come from positive performance, rather than net inflows.

- However, dig a bit deeper and you find that this is not true across the board. When we look at funds individually, only 47% of funds have generated profits that have exceeded net inflows.

According to the Aurum Hedge Fund Data Engine*, hedge fund industry assets have grown by $1.3tn in the past ten years. That’s 63% growth in a decade. Over the same period, the number of actively reporting hedge funds has actually fallen by 19%.

Hedge fund industry assets have grown by 63% in a decade

Hedge funds are often criticised for focusing on generating management fee income by accumulating assets through asset raising, often to the detriment of performance generated for their investors. Investment options narrow as assets increase, with larger managers limited to the most liquid investments, and less able to trade around positions.

But has the growth in hedge fund industry assets really come from asset raising/net inflows? Or has the growth come more from positive performance?

Hedge fund industry

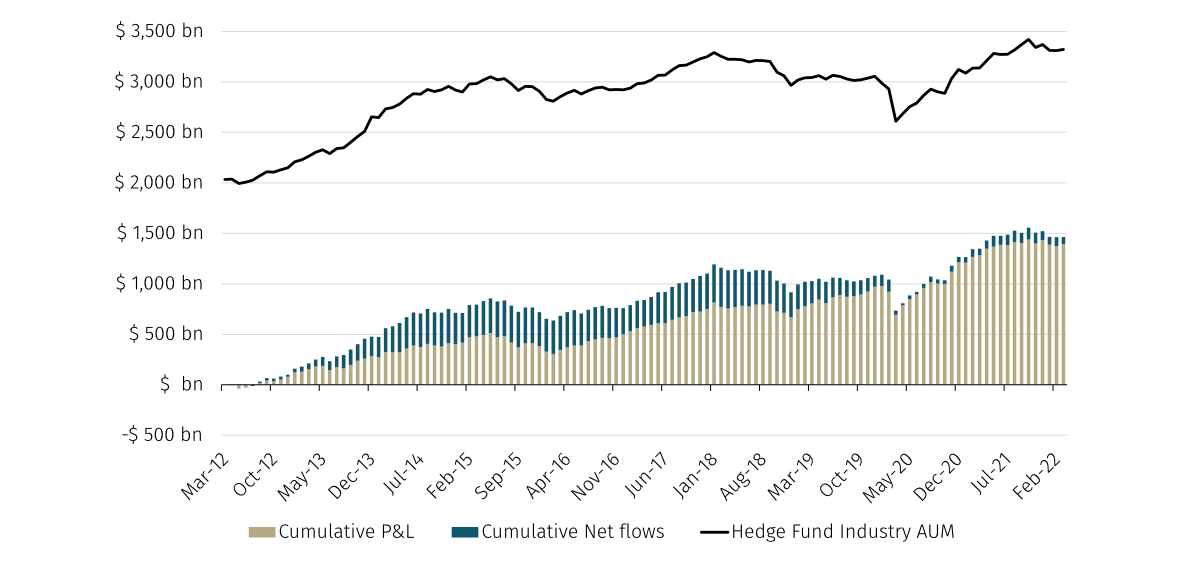

Drilling into the data in the Aurum Hedge Fund Data Engine shows that net inflows contributed just 5% to hedge fund industry growth over the period whilst performance contributed 95% of the reported $1.3tn of hedge fund industry asset growth seen over the past decade.

95% of hedge fund industry growth has come from performance

HEDGE FUND INDUSTRY CUMULATIVE P&L AND NET FLOWS AND AUM

Source: Aurum Hedge Fund Data Engine

Strategy level

Is the observation the same across hedge fund strategies? P&L growth for all hedge fund strategies monitored by the Aurum Hedge Fund Data Engine exceeded net inflows, with the exception of arbitrage. For some strategies, specifically credit, equity long/short, event driven, long biased, macro, and multi-strategy, performance represents more than 100% of the growth in assets, with these strategies experiencing net outflows in aggregate over the period.

Why has arbitrage been the exception? Subscriptions into arbitrage funds gained momentum after the increased market volatility in March 2020. It’s hard to draw direct conclusions, however it is likely that this, and the subsequent ongoing volatility, has piqued investor interest for non-directional and convexity strategies, like tail protection and volatility arbitrage.

Fund level

So far we’ve looked at the hedge fund industry in aggregate, and the trends when we look at hedge funds grouped into strategies. But if we drill down even further to the individual fund level, it’s quite a different picture. Only 47% of individual hedge funds have generated profits that have exceeded net inflows in the past decade. Only 71% of individual hedge funds have had cumulative positive net returns over the decade.

Only 47% of individual hedge funds have generated profits that have exceeded net inflows in the past decade

As mentioned above, the hedge fund industry is often criticised for accumulating investors’ assets in order to collect management fees, delivering lacklustre performance in return. However, breaking down the growth in the industry into performance generated and net subscriptions tells a different story at the headline level. Hedge fund growth in almost all strategies over the past decade has been predominantly performance-driven, i.e. growth has been predominantly organic.

But, decomposing the asset growth of the hedge fund industry in aggregate, or even by strategy, masks the role of individual funds in these trends. Despite performance representing 95% of the growth in hedge fund industry assets over the past decade, only half of funds made profits that exceeded net inflows over that period.

Rigorous due diligence and manager selection is critical for hedge fund investors. There are no shortcuts when analysing hedge funds, but the benefits are there for investors that are able to put in the significant investment in time and knowledge that is required.

*The Hedge Fund Data Engine is a proprietary database maintained by Aurum Research Limited (“ARL”). For information on index methodology, weighting and composition please refer to https://www.aurum.com/aurum-strategy-engine/. For definitions on how the Strategies and Sub-Strategies are defined please refer to https://www.aurum.com/hedge-fund-strategy-definitions/

Data from the Hedge Fund Data Engine is provided on the following basis: (1) Hedge Fund Data Engine data is provided for informational purposes only; (2) information and data included in the Hedge Fund Data Engine are obtained from various third party sources including Aurum’s own research, regulatory filings, public registers and other data providers and are provided on an “as is” basis; (3) Aurum does not perform any audit or verify the information provided by third parties; (4) Aurum is not responsible for and does not warrant the correctness, accuracy, or reliability of the data in the Hedge Fund Data Engine; (5) any constituents and data points in the Hedge Fund Data Engine may be removed at any time; (6) the completeness of the data may vary in the Hedge Fund Data Engine; (7) Aurum does not warrant that the data in the Hedge Fund Data Engine will be free from any errors, omissions or inaccuracies; (8) the information in the Hedge Fund Data Engine does not constitute an offer or a recommendation to buy or sell any security or financial product or vehicle whatsoever or any type of tax or investment advice or recommendation; (9) past performance is no indication of future results; and (10) Aurum reserves the right to change its Hedge Fund Data Engine methodology at any time and may elect to supress or change underlying data should it be considered optimal for representation and/or accuracy.

Disclaimer

This Post represents the views of the author and their own economic research and analysis. These views do not necessarily reflect the views of Aurum Fund Management Ltd.. This Post does not constitute an offer to sell or a solicitation of an offer to buy or an endorsement of any interest in an Aurum Fund or any other fund, or an endorsement for any particular trade, trading strategy or market. This Post is directed at persons having professional experience in matters relating to investments in unregulated collective investment schemes, and should only be used by such persons or investment professionals. Hedge Funds may employ trading methods which risk substantial or complete loss of any amounts invested. The value of your investment and the income you get may go down as well as up. Any performance figures quoted refer to the past and past performance is not a guarantee of future performance or a reliable indicator of future results. Returns may also increase or decrease as a result of currency fluctuations. An investment such as those described in this Post should be regarded as speculative and should not be used as a complete investment programme. This Post is for informational purposes only and not to be relied upon as investment, legal, tax, or financial advice. Whilst the information contained in this Post (including any expression of opinion or forecast) has been obtained from, or is based on, sources believed by Aurum to be reliable, it is not guaranteed as to its accuracy or completeness. This Post is current only at the date it was first published and may no longer be true or complete when viewed by the reader. This Post is provided without obligation on the part of Aurum and its associated companies and on the understanding that any persons who acting upon it or changes their investment position in reliance on it does so entirely at their own risk. In no event will Aurum or any of its associated companies be liable to any person for any direct, indirect, special or consequential damages arising out of any use or reliance on this Post, even if Aurum is expressly advised of the possibility or likelihood of such damages.