Hedge Fund Data

Equity long/short deep dive – May 22

In summary…

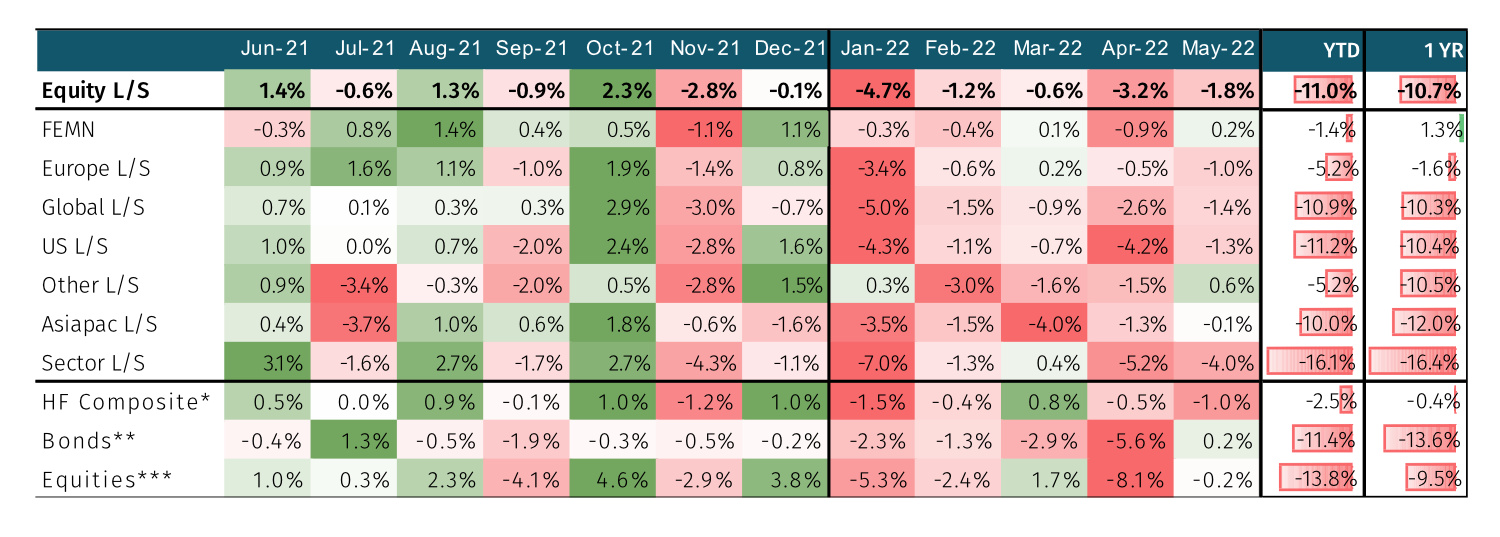

- Equity l/s underperformed over the past year, with the strategy underperforming directional equities, as well as the broader hedge fund universe.

- Equity l/s funds tracked by Aurum lost 10.7% on an asset-weighted basis, compared with a loss of 9.5% in the S&P Global BMI Index, and a loss of 0.4% in the HF Composite*.

- At the sub-strategy level, sector l/s was hit hardest, losing 16.4%, while Europe l/s and fundamental equity market neutral (“FEMN”) outperformed, losing 1.6% and gaining 1.3% respectively.

- The strategy has demonstrated more worth over longer time horizons, outperforming the broader hedge fund universe over the past 10 years (albeit with higher beta) and outperforming directional equities over the past 15 years.

- Equity l/s assets decreased by $80 billion over the year, representing an approximate 12% decrease in assets. Performance accounted for the vast majority of the decrease in assets, with net outflows reasonably contained.

Data updated on 15/07/2022. See note below.

Performance

Equity l/s underperformed over the past year, with the strategy underperforming directional equities, as well as the broader hedge fund universe. Equity l/s funds tracked by Aurum lost 10.7% on an asset-weighted basis over the year through May 2022, compared with a loss of 9.5% in the S&P Global BMI Index, and a loss of 0.4% in the HF Composite*. The vast majority of losses occurred in the first five months of 2022, as fears surrounding inflation, the war in Ukraine, and future growth fuelled an increase in global equity market volatility.

It is unsurprising that the equity l/s strategy should struggle in a period of declining equities, given that most equity l/s funds are managed with meaningful net long exposure to the asset class—data tracked by Aurum suggests that average net exposure for equity l/s funds was around +50% at the beginning of the review period in June 2021. However, in addition to losses attributable to the relatively high beta of the strategy, equity l/s exhibited meaningful alpha destruction (i.e. negative alpha) over the year (see full report).

In addition to losses attributable to the relatively high beta of the strategy, equity l/s exhibited meaningful alpha destruction over the year.

Why might this be so? Equity l/s funds have traditionally focused on technology-related, consumer discretionary, and healthcare sectors, as these sectors tend to exhibit healthy levels of dispersion between the performance of constituent stocks (‘winners’ and ‘losers’). While more macro-dependent, industrials and financials also tend to be popular hunting grounds for equity l/s managers, given the significance of these sectors. With the exception of healthcare, four out of these aforementioned ‘big five’ sectors led losses within equities over the year, with technology-related sectors hit particularly hard. By contrast, sectors in which equity l/s funds tend to traffic less, such as consumer staples, materials, utilities, and energy, outperformed in the recent challenging conditions. Energy in particular posted stellar gains, though this sector has been particularly under-represented in equity l/s portfolios, after several challenging years.

From a factor perspective, equity l/s managers have also favoured growth stocks over value stocks in recent years, driven by the meaningful and prolonged outperformance of the growth factor. Furthermore, equity l/s funds commonly utilise leverage to some extent, which can exacerbate losses in challenging periods, particularly as equity l/s funds often traffic in similar names, resulting in sometimes sharp unwinding of ‘crowded’ positions.

NET RETURN OF MASTER AND SUB-STRATEGIES (12M)

*HF Composite = Aurum Hedge Fund Data Engine Asset Weighted Composite Index. **Bonds = S&P Global Developed Aggregate Ex Collateralized Bond (USD). ***Equities = S&P Global BMI.

Sub-strategy performance

At the sub-strategy level, sector l/s was hit hardest, losing 16.4% over the year, while Europe l/s and FEMN outperformed on a relative basis, losing 1.6% and gaining 1.3% respectively. The remaining sub-strategies performed roughly in line with performance for the overall strategy, with Asia Pacific l/s losing 12.0%, global l/s losing 10.3%, US l/s losing 10.4%, and other l/s (largely comprised of emerging market-focused funds) losing 10.5%.

The underperformance of sector funds is understandable in the context of the underperformance of sectors typically favoured by equity l/s funds noted above. Similarly, the outperformance of Europe-focused funds is consistent with the largely ‘old world’ composition of European equities. The US is often characterised as a growth market, given the strength of its technology sector, while Europe as a value market. In addition, Europe-focused funds tend to be conservatively-managed with lower net market exposures. While lost in the struggles of China-focused funds within the Asia Pacific sub-sector, Japan-focused funds also outperformed. This was likely the result of similar factors informing the outperformance of Europe-focused funds, namely the ‘old world’, value-oriented nature of Japanese equities, and the prevalence of lower net market exposures among Japanese equity l/s funds.

FEMN, Aurum’s favoured strategy for pursuing opportunities within equities, also understandably outperformed, given low market participation. The strategy was nevertheless hampered to some extent by the macro-driven nature of markets over the year, as the impact of the virus, monetary policy to address inflation, and the war in Ukraine dominated, resulting in significant factor volatility and company fundamentals mattering less.

The underperformance of sector funds is understandable in the context of the underperformance of sectors typically favoured by equity l/s funds.

Longer term performance

A similar picture of underperformance for the equity l/s strategy relative to directional equities and the broader hedge fund universe emerges over a longer time horizon of the past five years. However, extending the look-back period to 10 and 15 years offers a more flattering perspective. While the strategy underperformed directional equities on a 10-year basis, it outperformed the broader hedge fund universe, with the equity l/s funds tracked by Aurum compounding annually on an asset-weighted basis at 5.8% over the past 10 years, compared with a compound annual return of 5.1% for the broader hedge fund universe tracked by Aurum. While absolute returns were solid relative to other hedge fund strategies, the quality of returns was less impressive, with the strategy exhibiting the second highest beta and second lowest alpha relative to global equities. Only the long-biased strategy group exhibited higher beta and lower alpha.

In terms of the 15-year look-back period, which includes the Global Financial Crisis of 2008, while the strategy slightly underperformed the broader hedge fund universe, it outperformed directional equities (respective compounds of 4.4% and 3.4%). As markets enter a potentially more challenging regime for directional equities, there is therefore reason for optimism that, after the pain of recent months, equity l/s funds can regroup and once again show their worth relative to directional benchmarks.

As we enter a potentially more challenging regime for directional equities, there is reason for optimism that equity l/s funds can once again show their worth.

Alpha extraction

Considering dollar performance decomposition for each sub-strategy provides a more granular picture of where alpha (relative to global equities) has been created and destroyed. Since January 2013, alpha has represented 36% of dollars generated within the equity l/s strategy group, with beta representing 46% of gains, and the risk-free rate of return representing 18% of gains. At the sub-strategy level, alpha represented the highest proportion of gains for FEMN at 57% of gains. The relatively high alpha content to the returns of FEMN is understandable, given the strategy’s low net market exposure.

Sub-strategies with the lowest alpha representation in returns were sector l/s and other l/s, which actually exhibited alpha destruction, with alpha representing -5% and -15% of dollars generated respectively, and beta accounting for the vast majority of gains.

Performance dispersion

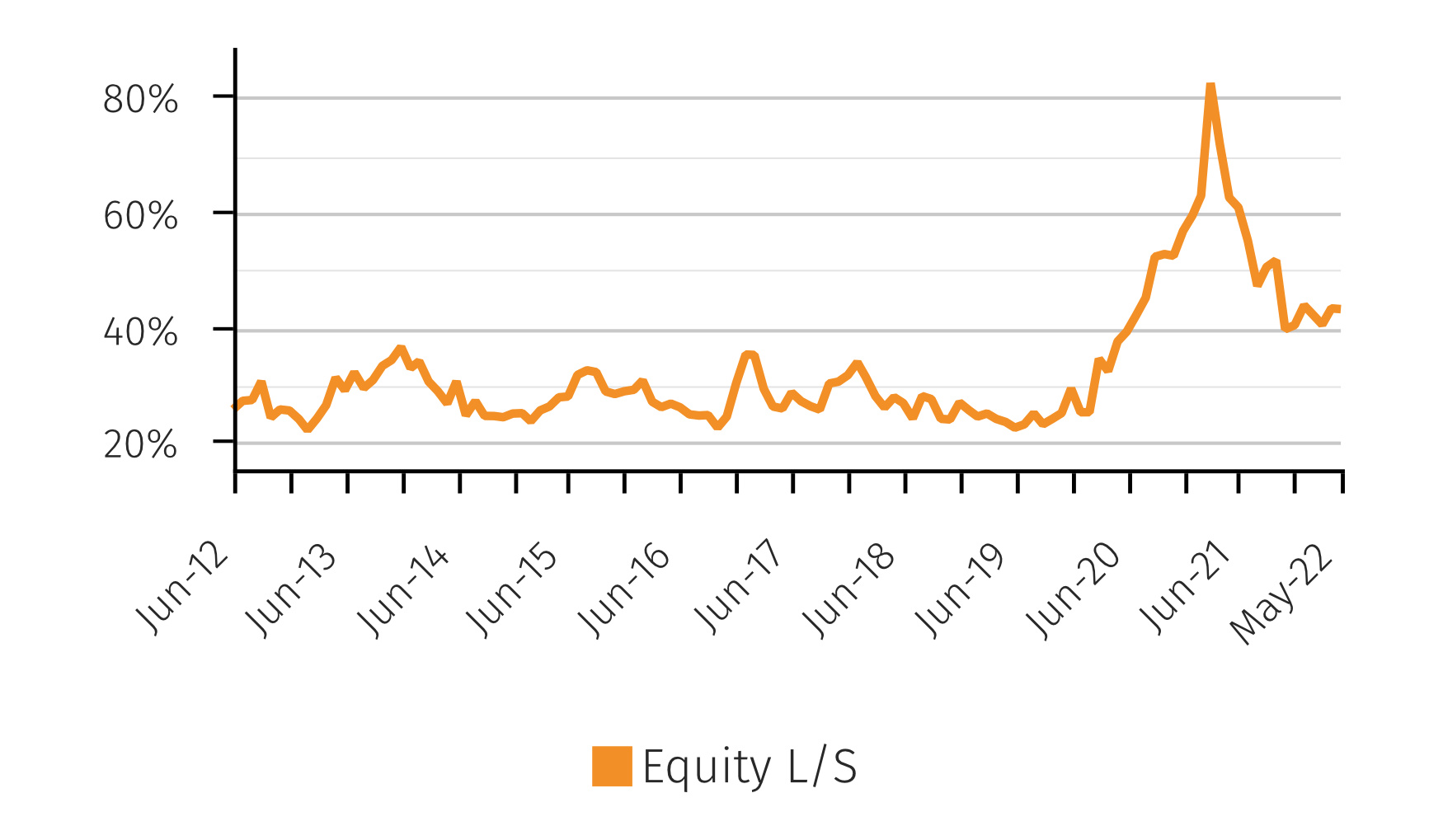

Average and aggregate data are only part of the story. Within strategy groupings there can be significant dispersion in returns. 12-month rolling return dispersion for the equity l/s strategy (see full report) peaked at over 80% in the first quarter of 2021, on the back of the events of 2020. While dispersion has reduced to less than 45% in recent months, it remains elevated relative to the 25-35% range exhibited in the 2012 to 2019 period. While the equity l/s strategy underperformed of late, the elevated levels of performance dispersion suggests that significant value can be added from fund selection. The top decile of funds delivered returns of close to 20% over the past 12 months, while the bottom decile lost over 25% (see full report).

10th – 90th PERCENTILE 12M ROLLING NET PERF. SPREAD

Source: Aurum Hedge Fund Data Engine.

At the sub-strategy level, dispersion has followed a similar path, however, strategies that typically exhibit lower return volatility, such as FEMN and Europe l/s, have exhibited lower dispersion. By contrast, sector l/s, other l/s, and US l/s exhibited higher dispersion. The top decile of US l/s funds performed best, returning well over 25%, while the bottom decile of the sector l/s funds performed worst, losing over 35%.

While the equity l/s strategy has underperformed of late, the elevated levels of performance dispersion suggests that significant value can be added from fund selection.

Assets and flows

At the end of May 2022, the ~1,000 equity l/s funds tracked by Aurum managed $574 billion, representing 18.5% of the assets managed by the broader hedge fund universe tracked by Aurum. The largest sub-strategies were sector l/s, global l/s, and US l/s, representing 31%, 21%, and 18% of equity l/s assets respectively. The average equity l/s fund managed $559 million, ranging from $223 million in the case of other l/s to $754 million in the case of global l/s.

Equity l/s assets decreased by $80 billion over the past year, representing an approximate 12% decrease in assets. Performance accounted for the vast majority of the decrease in assets (88%), with net outflows representing 12% of the decrease. At the sub-strategy level, sector l/s and Asia Pacific l/s experienced net subscriptions despite the recent poor performance, while FEMN and Europe l/s experienced net redemptions despite the recent outperformance.

Terms

The median liquidity terms for equity l/s funds tracked by Aurum are monthly with 45 days’ notice. However, the asset-weighted average number of redemption days is 136, suggesting that larger funds, not surprisingly, offer worse liquidity terms than smaller peers. The asset-weighted average management and performance fees are 1.46% and 19.1% respectively, suggesting that the days of “two and 20” for equity l/s funds have long passed. At the sub-strategy level, sector funds are amongst the most expensive and least liquid, terms which may become pressured given the strategy’s underperformance in recent months.

Note: The data in this report was restated as at x July to fix a technical issue that impacted reported AUM data history of constituent hedge funds within Equity long/short. This fix has resulted in restated number of funds and AUM for the strategy at May 2022, which are now 1,104 and $574bn respectively.

*The Hedge Fund Data Engine is a proprietary database maintained by Aurum Research Limited (“ARL”). For information on index methodology, weighting and composition please refer to https://www.aurum.com/aurum-strategy-engine/. For definitions on how the Strategies and Sub-Strategies are defined please refer to https://www.aurum.com/hedge-fund-strategy-definitions/

Bond and equity indices

The S&P Global BMI and S&P Global Developed Aggregate Ex Collateralized Bond (USD) Total Return Index (the “S&P Indices”) are products of S&P Dow Jones Indices LLC, its affiliates and/or their licensors and has been licensed for use by Aurum Research Limited. Copyright © 2021 S&P Dow Jones Indices LLC, its affiliates and/or their licensors. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC. For more information on any of S&P Dow Jones Indices LLC’s indices please visit www.spdji.com. S&P® is a registered trademark of Standard & Poor’s Financial Services LLC and Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC. Neither S&P Dow Jones Indices LLC, Dow Jones Trademark Holdings LLC, their affiliates nor their third party licensors make any representation or warranty, express or implied, as to the ability of any index to accurately represent the asset class or market sector that it purports to represent and neither S&P Dow Jones Indices LLC, Dow Jones Trademark Holdings LLC, their affiliates nor their third party licensors shall have any liability for any errors, omissions, or interruptions of any index or the data included therein. By accepting delivery of this Paper, the reader: (a) agrees it will not extract any index values from the Paper nor will it store, reproduce or further distribute the index values to any third party for any purpose in any format or by any means except that reader may store the Paper for its personal, non-commercial use; (b) acknowledges and agrees that S&P own the S&P Indices, the associated index values and all intellectual property therein and (c) S&P disclaims any and all warranties and representations with respect to the S&P Indices.