Hedge Fund Data

Hedge fund industry performance deep dive – Q3 2023

In summary…

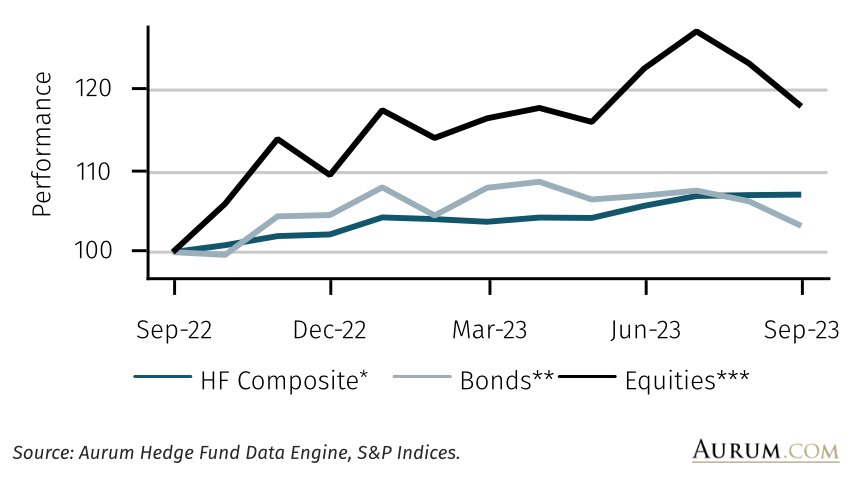

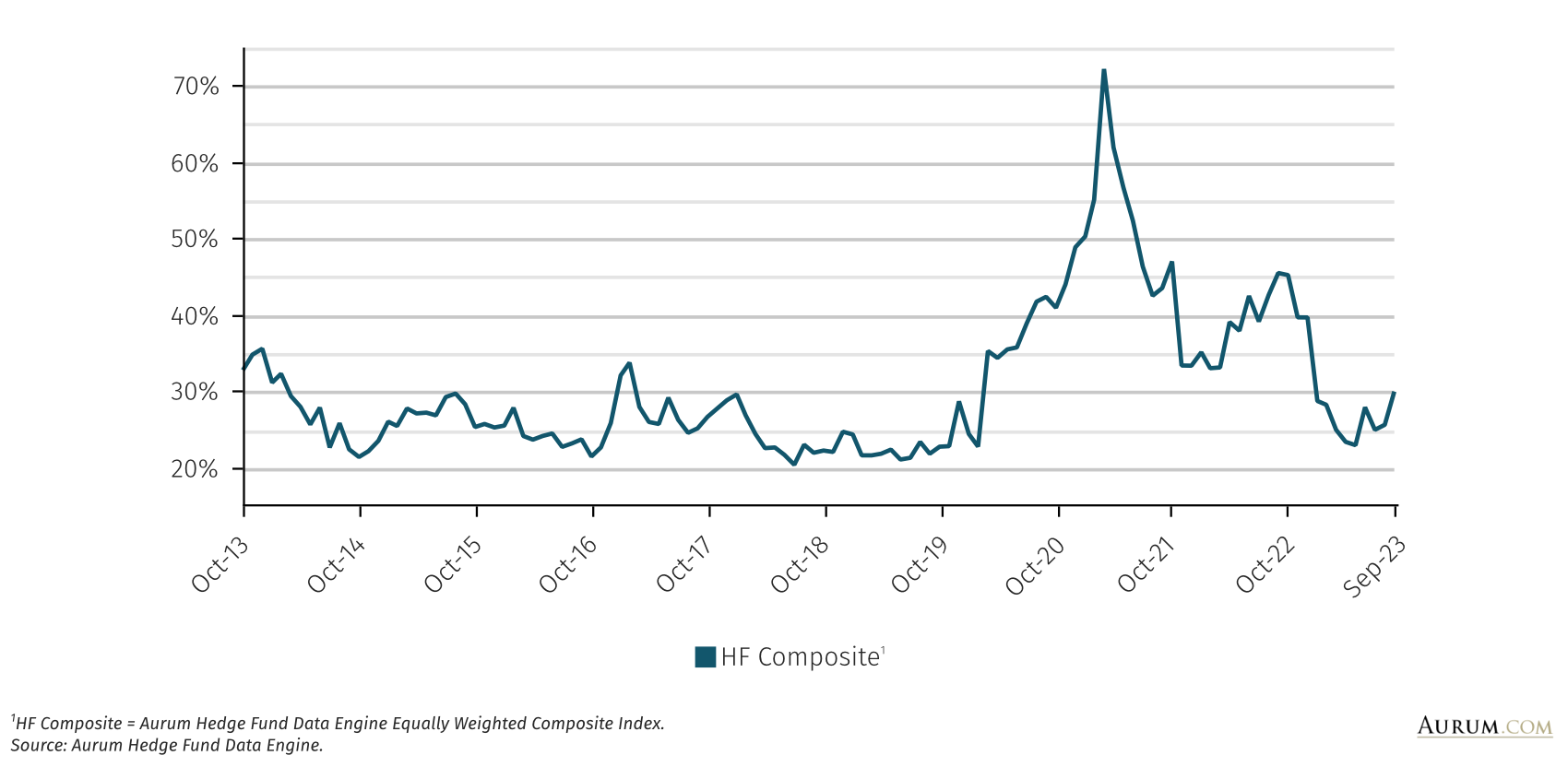

- Five-year CAR for hedge funds was at 4.9% at the end of Q3, above bonds at -1.7% and just above equities at 4.1%.

- Global equities*** and bonds** were both down over the quarter, returning -3.8% and -3.5% respectively.

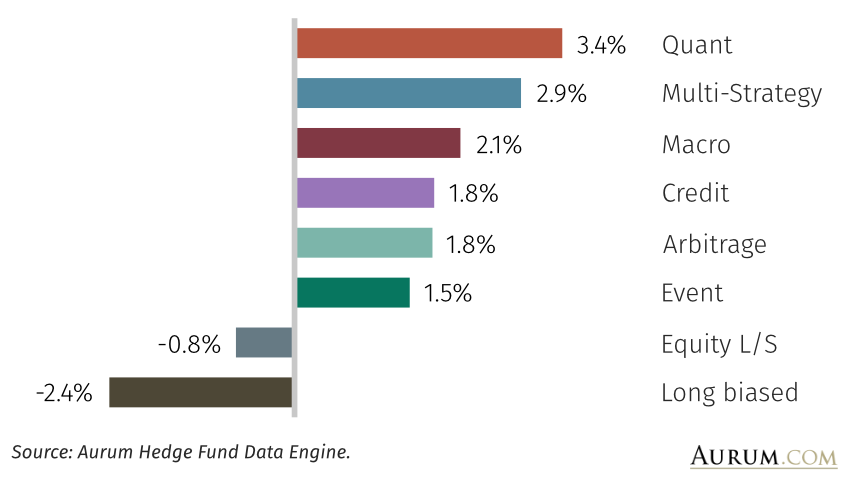

- Equity l/s and long biased, strategies with higher beta to equities, were the worst performing strategies over the quarter, having been the top performers in H1.

- Quant was the top performing strategy for the quarter, returning 3.4%.

- The top performing strategies year-to-date are multi-strategy up 5.9% and credit up 5.6%.

- Performance dispersion increased over the quarter.

HF COMPOSITE* VS INDICES (1 YR)

NET RETURN (QTD)

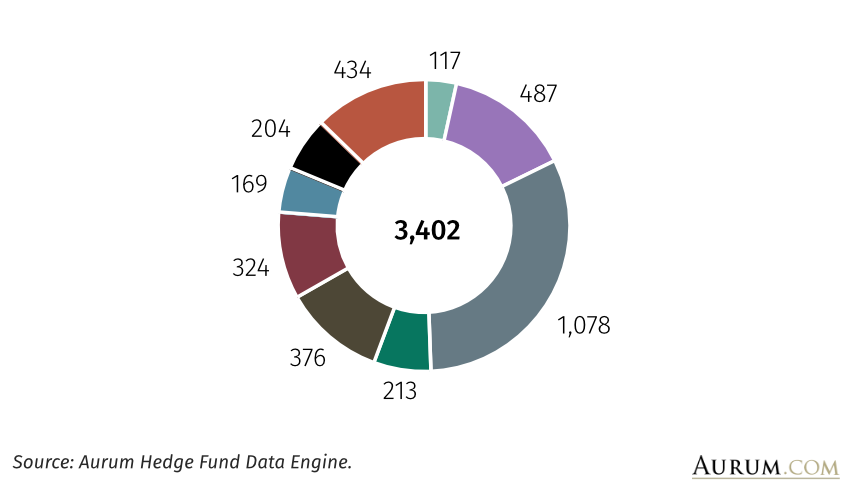

FUND COUNT – SEPTEMBER 23

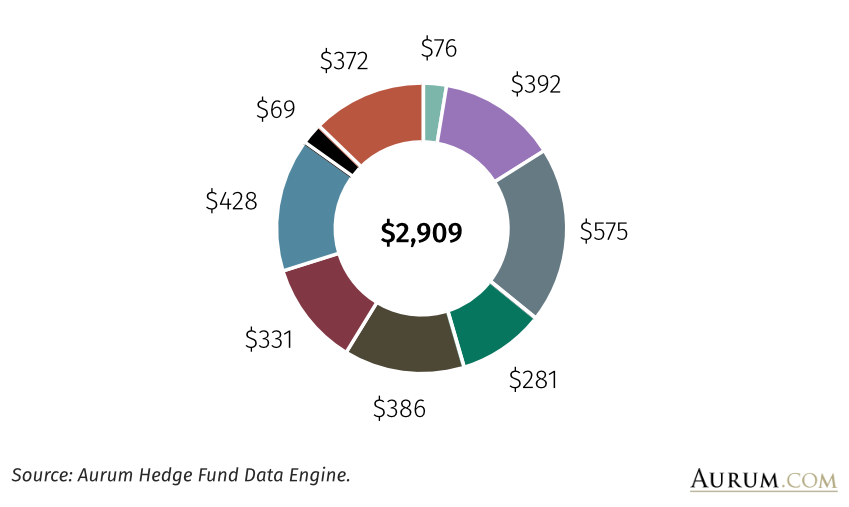

AUM ($BN) – SEPTEMBER 23

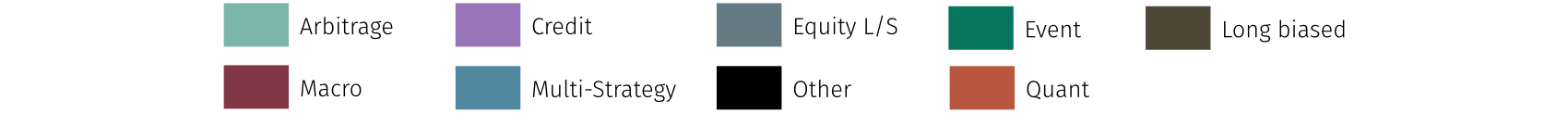

10th – 90th PERCENTILE 12M ROLLING PERFORMANCE SPREAD

NET RETURN (1 YR)

MASTER STRATEGY MULTIPLE PERIOD – HIERARCHICAL ANNUALISED NET RETURN TO SEPTEMBER 2023

*HF Composite = Aurum Hedge Fund Data Engine Asset Weighted Composite Index.

**Bonds = S&P Global Developed Aggregate Ex Collateralized Bond (USD).

***Equities = S&P Global BMI.

All figures and charts use asset weighted net returns unless otherwise stated. All Hedge Fund data is sourced from Aurum Hedge Fund Data Engine. Data included in this report is dated as at 18th October 2023.

The Hedge Fund Data Engine is a proprietary database maintained by Aurum Research Limited (“ARL”). For information on index methodology, weighting and composition please refer to https://www.aurum.com/aurum-strategy-engine/. For definitions on how the Strategies and Sub-Strategies are defined please refer to https://www.aurum.com/hedge-fund-strategy-definitions/

Bond and equity indices

The S&P Global BMI and S&P Global Developed Aggregate Ex Collateralized Bond (USD) Total Return Index (the “S&P Indices”) are products of S&P Dow Jones Indices LLC, its affiliates and/or their licensors and has been licensed for use by Aurum Research Limited. Copyright © 2021 S&P Dow Jones Indices LLC, its affiliates and/or their licensors. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC. For more information on any of S&P Dow Jones Indices LLC’s indices please visit www.spdji.com. S&P® is a registered trademark of Standard & Poor’s Financial Services LLC and Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC. Neither S&P Dow Jones Indices LLC, Dow Jones Trademark Holdings LLC, their affiliates nor their third party licensors make any representation or warranty, express or implied, as to the ability of any index to accurately represent the asset class or market sector that it purports to represent and neither S&P Dow Jones Indices LLC, Dow Jones Trademark Holdings LLC, their affiliates nor their third party licensors shall have any liability for any errors, omissions, or interruptions of any index or the data included therein. By accepting delivery of this Paper, the reader: (a) agrees it will not extract any index values from the Paper nor will it store, reproduce or further distribute the index values to any third party for any purpose in any format or by any means except that reader may store the Paper for its personal, non-commercial use; (b) acknowledges and agrees that S&P own the S&P Indices, the associated index values and all intellectual property therein and (c) S&P disclaims any and all warranties and representations with respect to the S&P Indices.