Hedge Fund Data

Quant deep dive – Aug 22

In summary…

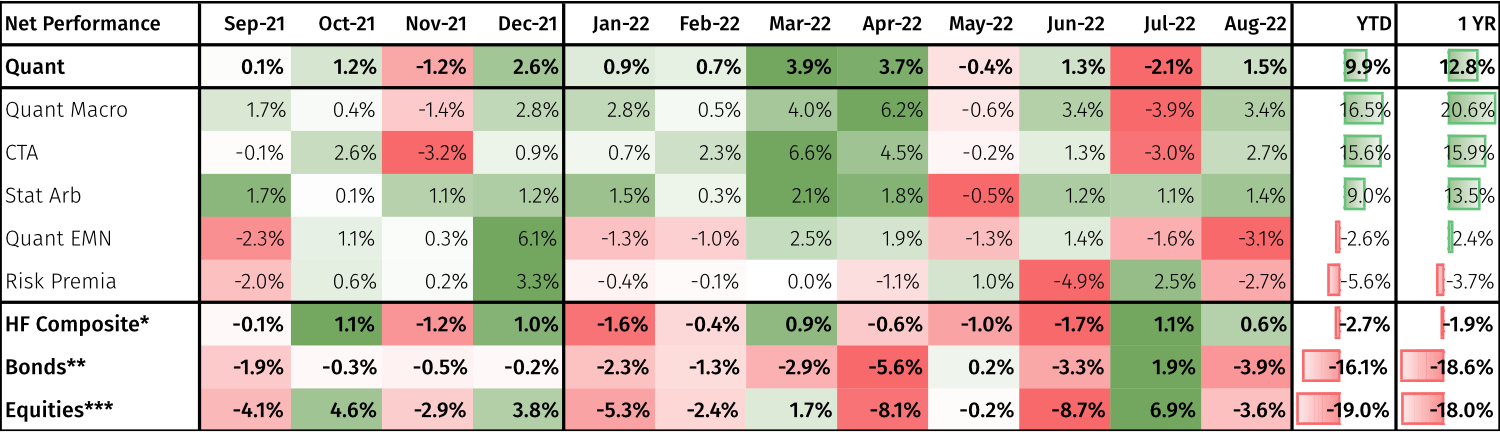

- Quant funds generated an average return of 12.8% in the 12 months to August 2022

- Strategy AUM has grown by $42.8bn, net profits contributed $47.8bn of this growth and net outflows were $5.0bn.

- Quant macro was the strongest performing quant sub-strategy, generating an average return of 20.6%.

- Statistical arbitrage had the lowest standard deviation amongst the quant sub-strategies and suffered only one negative month in the period.

Performance

Quant has exhibited exceptional positive performance over the 12 months to August 2022, delivering an average return of 12.8%. The strategy was positive for 9 of those 12 months, with the worst monthly drawdown in July 2022 when the master strategy was down 2.1%. The best monthly return for the period was 3.9% followed closely by 3.7% in March 2022 and April 2022 respectively.

The second largest strategy monitored by Aurum’s Hedge Fund Data Engine by AUM is quant, accounting for $445bn out of $3,143bn combined AUM monitored as at August 2022. The quant master strategy AUM over the period grew by $42.8bn; the growth was primarily due to net profits of $47.8bn with net outflows of $5.0bn, while the total number of quant funds monitored decreased by seven funds from 483 funds to 476 funds. At a sub-strategy level, the variance in observable funds were -6 funds across CTA, -5 in risk premia, -3 in quant equity market neutral and +7 in statistical arbitrage.

Net assets increased by $42.8bn over the 12 months to August 2022.

In terms of performance, quant was the best performer of all the hedge fund strategies observed in the 12 months to August 2022. All sub-strategies apart from risk premia had positive performance over the review period. It should be noted that there was a high level of performance dispersion between the top and bottom performing sub-strategies, ranging from -3.7% for risk premia to +20.6% for quant macro.

At the sub-strategy level, quant macro, CTA and statistical arbitrage outperformed, while risk premia and quant equity market neutral were more challenged. Both quant macro and CTA were well positioned for rising inflationary pressures through long positions in commodities, US dollar, and short fixed income. Statistical arbitrage benefited from elevated intra-month stock volatility and increased cross-sectional dispersion.

NET RETURN OF MASTER AND SUB STRATEGIES (1 YR)

*HF Composite = Aurum Hedge Fund Data Engine Asset Weighted Composite Index. **Bonds = S&P Global Developed Aggregate Ex Collateralized Bond (USD). ***Equities = S&P Global BMI.

Sub-strategy performance

Quant macro was the strongest performing quant sub-strategy generating an asset weighted average net return of 20.6%. The strategy recovered from their worst 12-month rolling performance over five years of -7.5% in July 2020. Quant macro has benefited from global inflationary pressures that have driven the Fed and other central banks to end their accommodative monetary policy. The sub-strategy has profited from long positions in energy, US dollar and short fixed income. CTA is the second best performing quant sub-strategy, benefitting from very similar positioning to quant macro as reflected by having very similar monthly return distributions over the trailing 12 months.

Quant macro has benefited from global inflationary pressures that have driven the Fed and other central banks to end their accommodative monetary policy.

Risk premia – the worst performing quant sub-strategy – generated a return of -3.7%. These losses, even though they are relatively modest when compared with equity markets, are harmful for a sub-strategy that has struggled to deliver meaningful returns over 10 years. Most of the recent losses can be attributable to bond carry trades, which tend to exhibit a net long duration risk. Long positioning in fixed income underperformed as prices fell and yields rose resulting from a tightening monetary policy from central banks, elevated inflation levels and declining appetite for fixed income.

Statistical arbitrage was the most consistent strategy with a 12 month standard deviation of only 2.7% with 11 out of 12 months delivering positive returns and the only down month detracting 0.5%. When viewing statistical arbitrage on a risk adjusted basis, it has delivered a Sharpe ratio of 2.17 over 3 years, significantly outperforming the quant master strategy that has a Sharpe ratio of 0.63.

Longer-term performance

Analysing the sub-strategies’ performance over several time horizons provides a comprehensive overview of performance across business cycles. When extending the look back period to three years, five years and ten years, statistical arbitrage consistently outperforms the other sub-strategies (see page 11 of the report). While quant macro has outperformed the broader hedge fund universe more recently, its performance over ten years was less impressive. The long-term underperformance of risk premia reflects on its low level of excess returns from specific risk across the quant universe.

Alpha extraction

The standout performing sub-strategy when evaluating the alpha/beta decomposition for each of the sub-strategies relative to global equities is statistical arbitrage. Since January 2013, only 2% of the cumulative dollars generated within the statistical arbitrage strategy are attributable to beta. On the other hand, most of the gains are attributable to alpha (see page 10 of the report). The high proportion of alpha gains is understandable given the strategy’s low net equity exposure and trading style.

Risk premia has the lowest alpha contribution across the sub-strategies within quant, and predictably has a high level of negative alpha since January 2013 (see page 10 of the report). The sub-strategy experienced a material drawdown in March 2020 resulting in negative PnL attributable from both alpha and beta and since then it has not been able to recover.

Since January 2013, only 2% of the cumulative dollars generated within the statistical arbitrage strategy are attributable to beta.

Performance dispersion

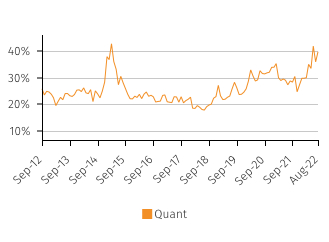

The rolling 12 month net interdecile performance spread across the quant strategy has expanded to the highest level it has been since December 2014 at 40%, up from a low of 18% in July 2018. The increased dispersion is a reflection on the increased market volatility, strategy divergence and intra-sub-strategy dispersion.

The sub-strategy with the largest dispersion over the last 12 months has been risk premia, which has also underperformed relative to the quant strategy and broader hedge fund universe.

10th – 90th PERCENTILE 12M ROLLING NET PERF. SPREAD

Source: Aurum Hedge Fund Data Engine.

Quant equity market neutral has the tightest dispersion at 24% and historically this has ranged from 14% to 35%. Given the high level of intra-strategy dispersion within quant, the potential rewards from picking high quality managers within quant is extremely compelling.

Assets and flows

Quant, the second largest strategy tracked by Aurum managed $445 billion at the end of August 2022 (see page 17 of the report), representing 14% of the assets managed by the broader hedge fund universe tracked by Aurum. The largest sub-strategy by number of funds and assets under management was CTA, representing 34% of quant assets and 51% of quant managers. The average assets managed by a fund ranged from $620 million in CTA to $2.1 billion in Quant Macro.

Net assets increased in quant by $42.8bn over the prevailing 12 months, with net increases coming from quant macro, CTA and statistical arbitrage. The vast majority of the rise in quant strategy assets came from performance as expected given the strategy gained 12.8% during the last 12 months. Risk premia and quant EMN saw significant investor outflows, while CTAs and quant macro saw material inflows relative to recent years.

Terms

On average, quant offers the best liquidity terms, with the median liquidity terms being monthly with five days’ notice. Unsurprisingly the weighted average redemption days is 52, implying that funds with greater assets have more onerous liquidity terms than smaller funds. The most illiquid terms, based on the weighted average comes from statistical arbitrage, not surprising given the stronger long-term performance of the strategy.

The weighted average management fee for quant is 1.6%, ranging from a low of 0.7% for risk premia to a high of 2.5% for statistical arbitrage. It is not surprising that the average management fee is materially lower for risk premia than it is for other quant sub-strategies. The weighted average performance fee for quant is 17.6%, with sub-strategy fees ranging from a low of 6.3% for risk premia to a high of 24.1% for statistical arbitrage (see page 19 of the report).

The Hedge Fund Data Engine is a proprietary database maintained by Aurum Research Limited (“ARL”). For information on index methodology, weighting and composition please refer to https://www.aurum.com/aurum-strategy-engine/. For definitions on how the Strategies and Sub-Strategies are defined please refer to https://www.aurum.com/hedge-fund-strategy-definitions/

Bond and equity indices

The S&P Global BMI and S&P Global Developed Aggregate Ex Collateralized Bond (USD) Total Return Index (the “S&P Indices”) are products of S&P Dow Jones Indices LLC, its affiliates and/or their licensors and has been licensed for use by Aurum Research Limited. Copyright © 2021 S&P Dow Jones Indices LLC, its affiliates and/or their licensors. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC. For more information on any of S&P Dow Jones Indices LLC’s indices please visit www.spdji.com. S&P® is a registered trademark of Standard & Poor’s Financial Services LLC and Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC. Neither S&P Dow Jones Indices LLC, Dow Jones Trademark Holdings LLC, their affiliates nor their third party licensors make any representation or warranty, express or implied, as to the ability of any index to accurately represent the asset class or market sector that it purports to represent and neither S&P Dow Jones Indices LLC, Dow Jones Trademark Holdings LLC, their affiliates nor their third party licensors shall have any liability for any errors, omissions, or interruptions of any index or the data included therein. By accepting delivery of this Paper, the reader: (a) agrees it will not extract any index values from the Paper nor will it store, reproduce or further distribute the index values to any third party for any purpose in any format or by any means except that reader may store the Paper for its personal, non-commercial use; (b) acknowledges and agrees that S&P own the S&P Indices, the associated index values and all intellectual property therein and (c) S&P disclaims any and all warranties and representations with respect to the S&P Indices.