Insights

Why manager selection is critical when building a hedge fund portfolio

In summary…

Manager selection is critical when it comes to investing in hedge funds or fund of hedge funds. In the latter part of 2021, we did a short note looking at how investors in hedge funds that have a higher exposure to beta-driven strategies had been impacted by the turbulence of September that year. Since then market conditions have deteriorated further with both bonds and equities moving against investors—significantly impacting those holding traditional 60/40 portfolios.

So how have hedge fund investors fared against the backdrop of market turbulence this year?

With the major hedge fund indices showing significant negative performance to June 2022, you could be forgiven for thinking that hedge funds have been tested and failed this year. However, as we have previously noted, the hedge fund industry is not homogeneous and there is significant dispersion at both the strategy and manager level.

If we look beneath the headline numbers what do we find?

There are some strategies and managers who have successfully navigated the markets this year. Providing investors with both protection of capital during market downturns and capitalising on the opportunities presented.

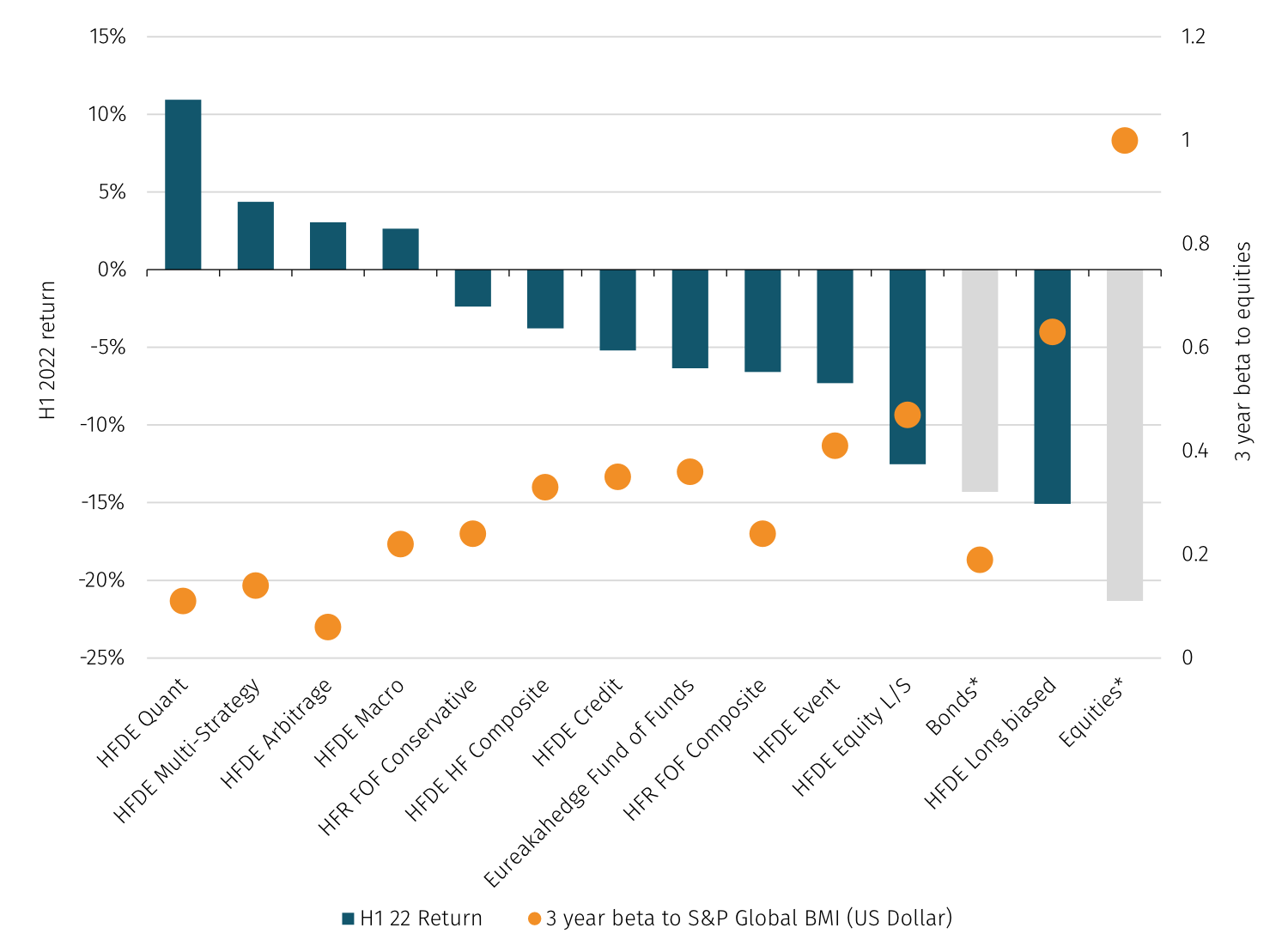

Those investors that favoured quant, multi-strategy, arbitrage, and macro funds should have seen positive returns so far this year. While, equity l/s, event, long biased, and credit generated negative returns for their investors to June 22.

PERFORMANCE (YTD TO JUNE 22) AND BETA TO EQUITIES (3YR)

HFDE refers to the Funds monitored in the Aurum Hedge Fund Data Engine. *Equities = S&P Global BMI (US Dollar), Bonds = S&P Global Developed Aggregate Ex Collateralized Bond (USD) Total Return Index Source: Aurum Hedge Fund Data Engine*

Perhaps it is unsurprising that those strategies with higher beta have underperformed this year. A strategy’s ability to generate alpha-based returns is an important indicator for investors.

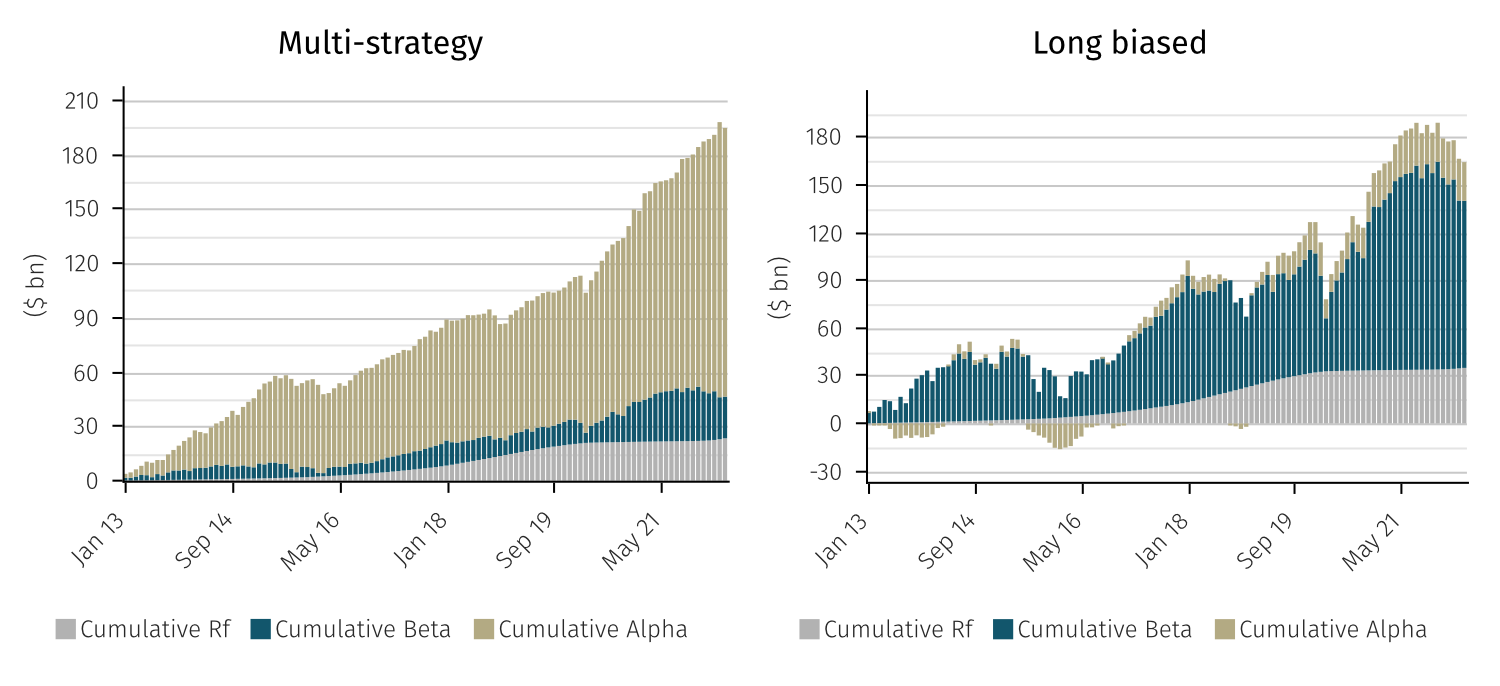

The charts below show two extremes when it comes to alpha generation since January 2013 (you can see the full data updated to June in our forthcoming Hedge Fund Industry Deep Dive later this month). Multi-strategy funds have derived over 75% of returns from alpha since January 2013, while long biased funds only generated 14% of returns from alpha over the same period.

Given market performance this year it is not surprising then that those strategies less reliant on beta have done a better job of protecting capital and generating returns for their investors.

These charts decompose aggregate dollar returns into beta, alpha, and risk-free (“Rf”) components, as follows: alpha = actual return – Rf – beta * (market return – Rf). Where Rf is the risk-free rate as defined by a rolling 3m USD Libor, where market return is that of S&P Global BMI (‘the market index’) and where beta has been calculated with respect to each underlying fund observed on a 24m rolling basis to the market index. The monthly alpha, beta and Rf components are then applied to each underlying fund’s dollar performance for a particular month, and then at a master strategy or industry level the individual fund dollar contributions are aggregated. Source: Aurum Hedge Fund Data Engine*

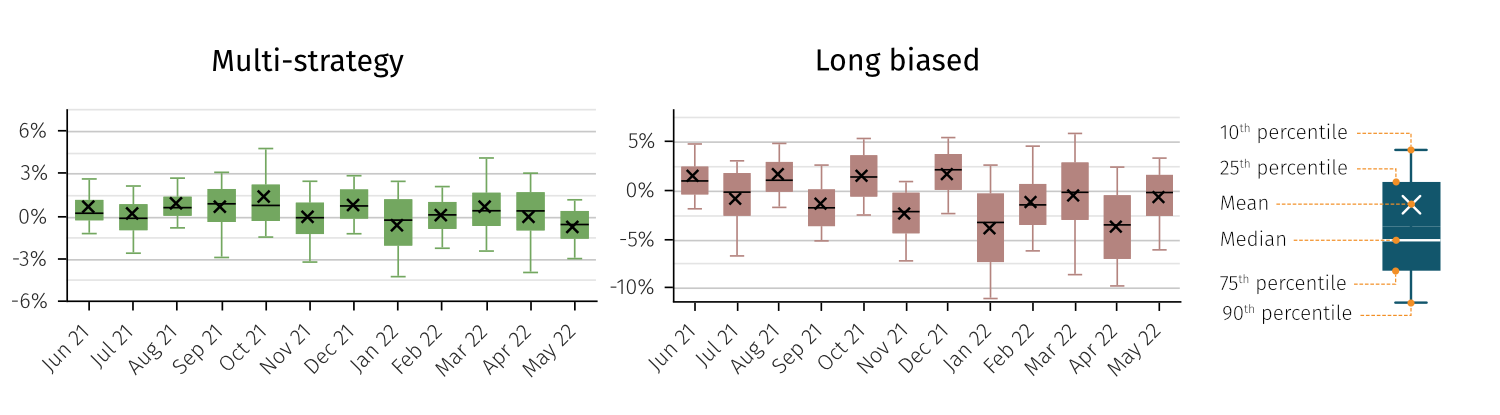

Dispersion

However, it is also important to consider the dispersion of performance at a manager level within strategies. As the charts below demonstrate, there are winners and losers in both of these strategy groupings. That is why manger selection is critical when building a portfolio of hedge funds.

Performance dispersion uses equally weighted returns. Source: Aurum Hedge Fund Data Engine*

Fund of hedge funds

You might expect then that fund of hedge fund managers would have been able to successfully navigate recent markets. Looking at the headline indices in the performance chart above, it seems disappointing that this has not been the case for many.

Aurum firmly believe in the value of the fund of hedge funds model. The experience, expertise, depth of research and access to managers that can be achieved using fund of hedge funds should represent good value for clients and deliver risk-adjusted returns that they could not achieve investing alone.

However, it seems choice of manager is just as critical when considering fund of hedge fund managers. It is important to understand their strategy and manager biases and also their investment philosophy to ensure that it fits well with an investor’s own investment objectives.

*The Hedge Fund Data Engine is a proprietary database maintained by Aurum Research Limited (“ARL”). For information on index methodology, weighting and composition please refer to https://www.aurum.com/aurum-strategy-engine/. For definitions on how the Strategies and Sub-Strategies are defined please refer to https://www.aurum.com/hedge-fund-strategy-definitions/

Data from the Hedge Fund Data Engine is provided on the following basis: (1) Hedge Fund Data Engine data is provided for informational purposes only; (2) information and data included in the Hedge Fund Data Engine are obtained from various third party sources including Aurum’s own research, regulatory filings, public registers and other data providers and are provided on an “as is” basis; (3) Aurum does not perform any audit or verify the information provided by third parties; (4) Aurum is not responsible for and does not warrant the correctness, accuracy, or reliability of the data in the Hedge Fund Data Engine; (5) any constituents and data points in the Hedge Fund Data Engine may be removed at any time; (6) the completeness of the data may vary in the Hedge Fund Data Engine; (7) Aurum does not warrant that the data in the Hedge Fund Data Engine will be free from any errors, omissions or inaccuracies; (8) the information in the Hedge Fund Data Engine does not constitute an offer or a recommendation to buy or sell any security or financial product or vehicle whatsoever or any type of tax or investment advice or recommendation; (9) past performance is no indication of future results; and (10) Aurum reserves the right to change its Hedge Fund Data Engine methodology at any time and may elect to supress or change underlying data should it be considered optimal for representation and/or accuracy.

Disclaimer

This Post represents the views of the author and their own economic research and analysis. These views do not necessarily reflect the views of Aurum Fund Management Ltd. This Post does not constitute an offer to sell or a solicitation of an offer to buy or an endorsement of any interest in an Aurum Fund or any other fund, or an endorsement for any particular trade, trading strategy or market. This Post is directed at persons having professional experience in matters relating to investments in unregulated collective investment schemes, and should only be used by such persons or investment professionals. Hedge Funds may employ trading methods which risk substantial or complete loss of any amounts invested. The value of your investment and the income you get may go down as well as up. Any performance figures quoted refer to the past and past performance is not a guarantee of future performance or a reliable indicator of future results. Returns may also increase or decrease as a result of currency fluctuations. An investment such as those described in this Post should be regarded as speculative and should not be used as a complete investment programme. This Post is for informational purposes only and not to be relied upon as investment, legal, tax, or financial advice. Whilst the information contained in this Post (including any expression of opinion or forecast) has been obtained from, or is based on, sources believed by Aurum to be reliable, it is not guaranteed as to its accuracy or completeness. This Post is current only at the date it was first published and may no longer be true or complete when viewed by the reader. This Post is provided without obligation on the part of Aurum and its associated companies and on the understanding that any persons who acting upon it or changes their investment position in reliance on it does so entirely at their own risk. In no event will Aurum or any of its associated companies be liable to any person for any direct, indirect, special or consequential damages arising out of any use or reliance on this Post, even if Aurum is expressly advised of the possibility or likelihood of such damages.

Bond and equity indices

The S&P Global BMI and S&P Global Developed Aggregate Ex Collateralized Bond (USD) Total Return Index (the “S&P Indices”) are products of S&P Dow Jones Indices LLC, its affiliates and/or their licensors and has been licensed for use by Aurum Research Limited. Copyright © 2021 S&P Dow Jones Indices LLC, its affiliates and/or their licensors. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC. For more information on any of S&P Dow Jones Indices LLC’s indices please visit www.spdji.com. S&P® is a registered trademark of Standard & Poor’s Financial Services LLC and Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC. Neither S&P Dow Jones Indices LLC, Dow Jones Trademark Holdings LLC, their affiliates nor their third party licensors make any representation or warranty, express or implied, as to the ability of any index to accurately represent the asset class or market sector that it purports to represent and neither S&P Dow Jones Indices LLC, Dow Jones Trademark Holdings LLC, their affiliates nor their third party licensors shall have any liability for any errors, omissions, or interruptions of any index or the data included therein. By accepting delivery of this Paper, the reader: (a) agrees it will not extract any index values from the Paper nor will it store, reproduce or further distribute the index values to any third party for any purpose in any format or by any means except that reader may store the Paper for its personal, non-commercial use; (b) acknowledges and agrees that S&P own the S&P Indices, the associated index values and all intellectual property therein and (c) S&P disclaims any and all warranties and representations with respect to the S&P Indices.