Insight

Three reasons why the best allocators invest in hedge funds

Investors are increasingly looking to hedge funds to provide portfolio protection against risk and volatility in periods of market stress in traditional asset classes. In the second part of Aurum’s “hedge fund basics” series, we look at the potential benefits of hedge fund investing, long-term hedge fund performance, and how they have delivered this portfolio protection.

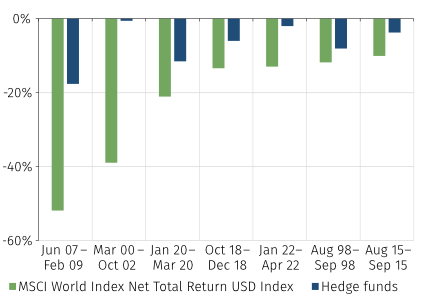

Downside protection

Hedge funds have a historic track record of mitigating significant losses during periods of crisis for traditional assets. By mitigating significant losses, hedge funds have the capacity to protect long-term portfolio value and support growth.

FIGURE 1: PERFORMANCE DURING EQUITY MARKET STRESS

Source: Bloomberg. Hedge funds = HFRI Fund Weighted Composite Index. Jan 1990 – Apr 2022

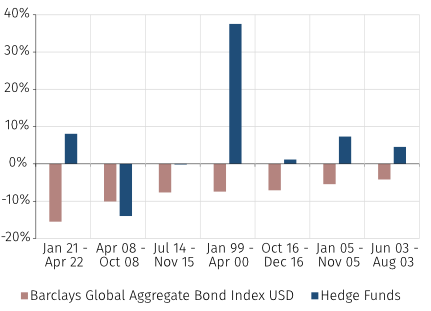

FIGURE 2: PERFORMANCE DURING BOND MARKET STRESS

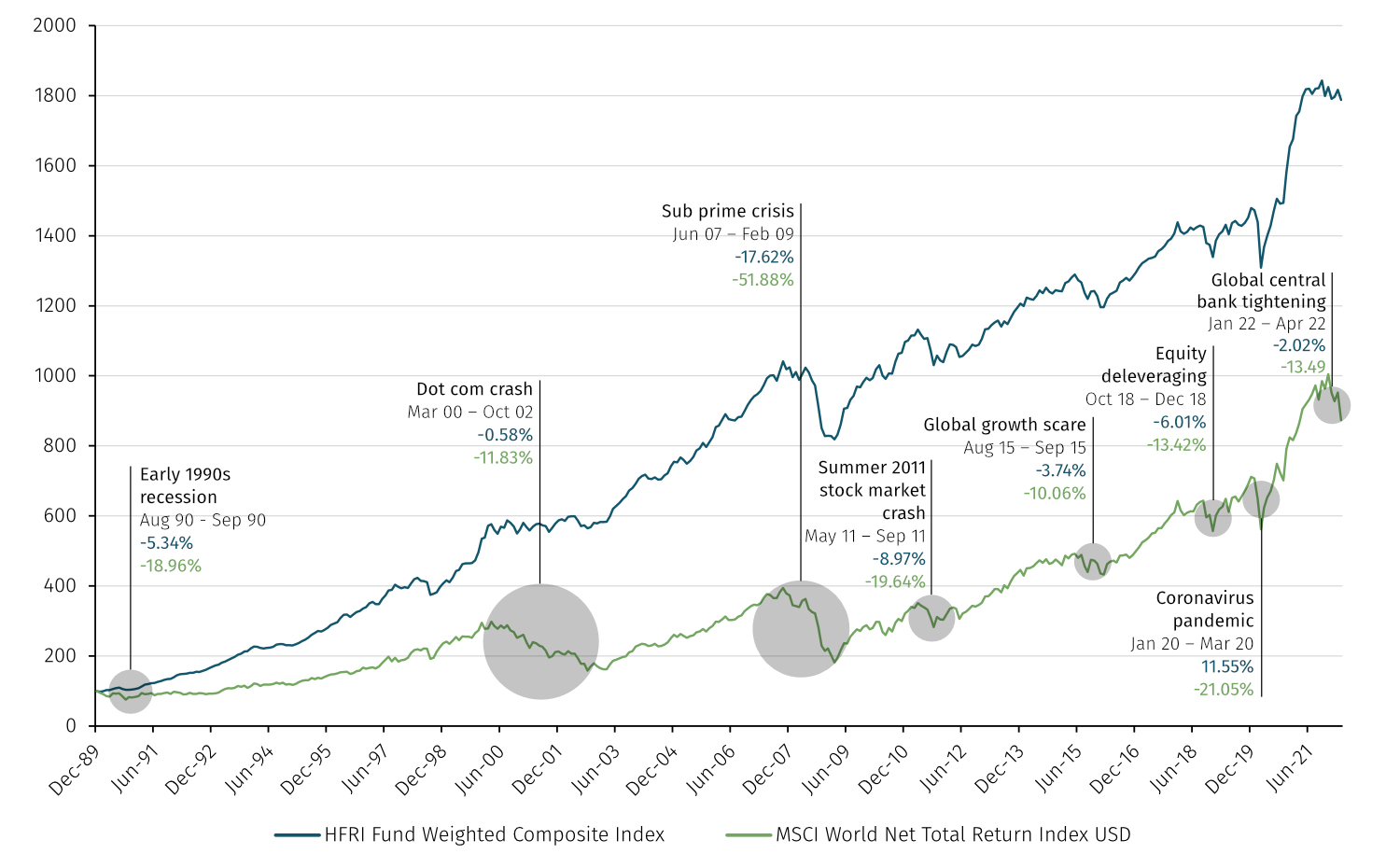

FIGURE 3: AVOIDING LOSS PAYS DIVIDENDS OVER TIME

Source: Bloomberg. rebased to the launch of the HFRI Fund Weighted Composite Index – Jan 1990

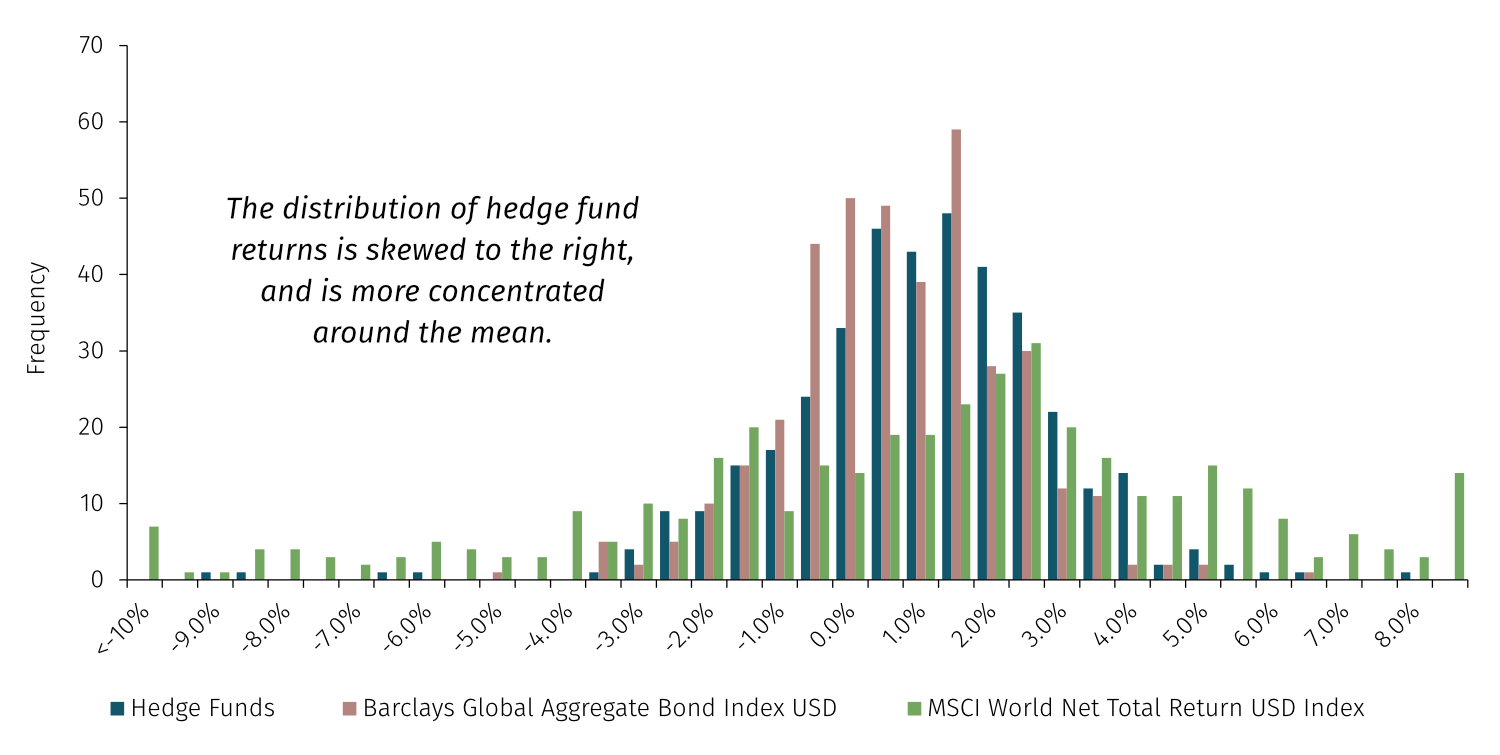

Lowering portfolio volatility

Hedge funds generally deliver a more consistent return profile than traditional investments, and with lower volatility. This is illustrated in the chart in Figure 7 below, which shows the more consistent distribution of returns of hedge funds vs. equities and bonds.

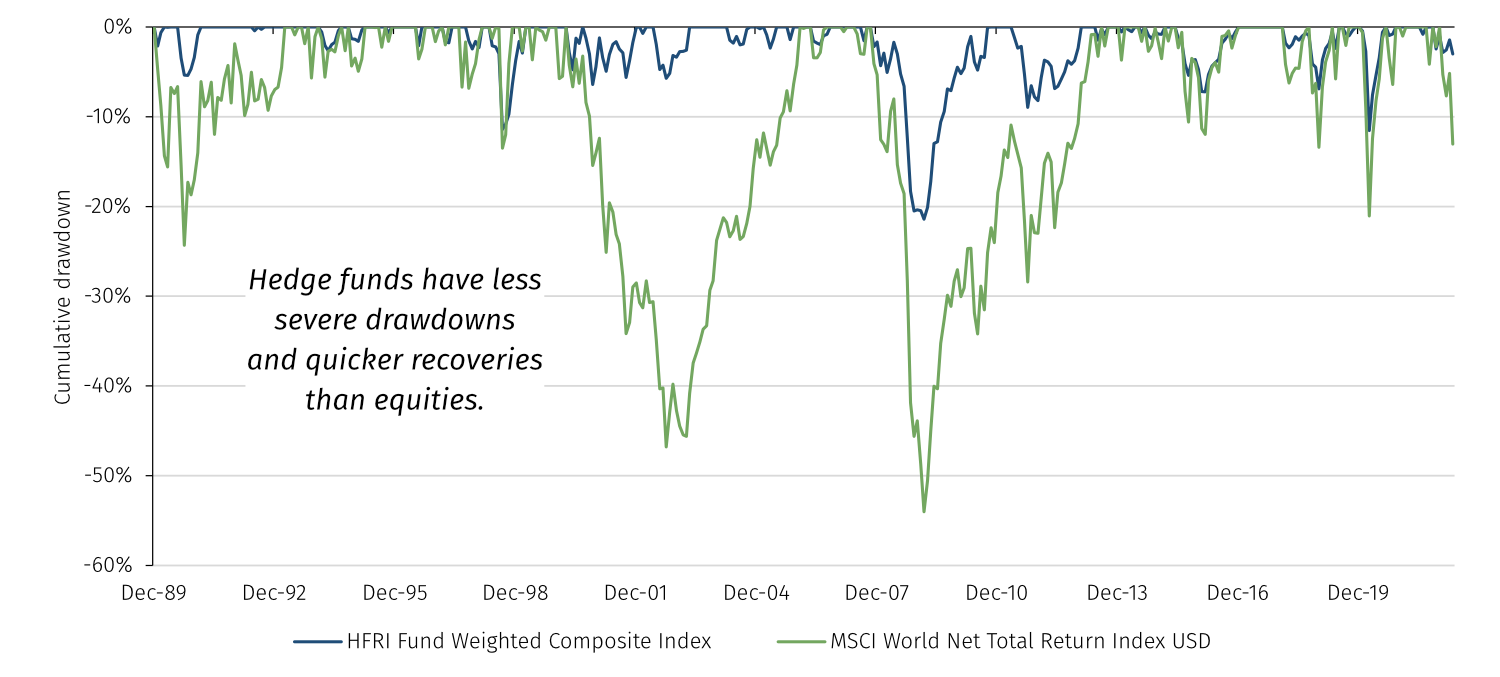

Including hedge funds in a balanced portfolio can reduce overall portfolio volatility by protecting on the downside (see Figure 4 below) and smoothing returns (see Figure 8 below).

FIGURE 4: HEDGE FUNDS OFFER MORE DOWNSIDE PROTECTION THAN EQUITIES

Source: Bloomberg. rebased to the launch of the HFRI Fund Weighted Composite Index – Jan 1990

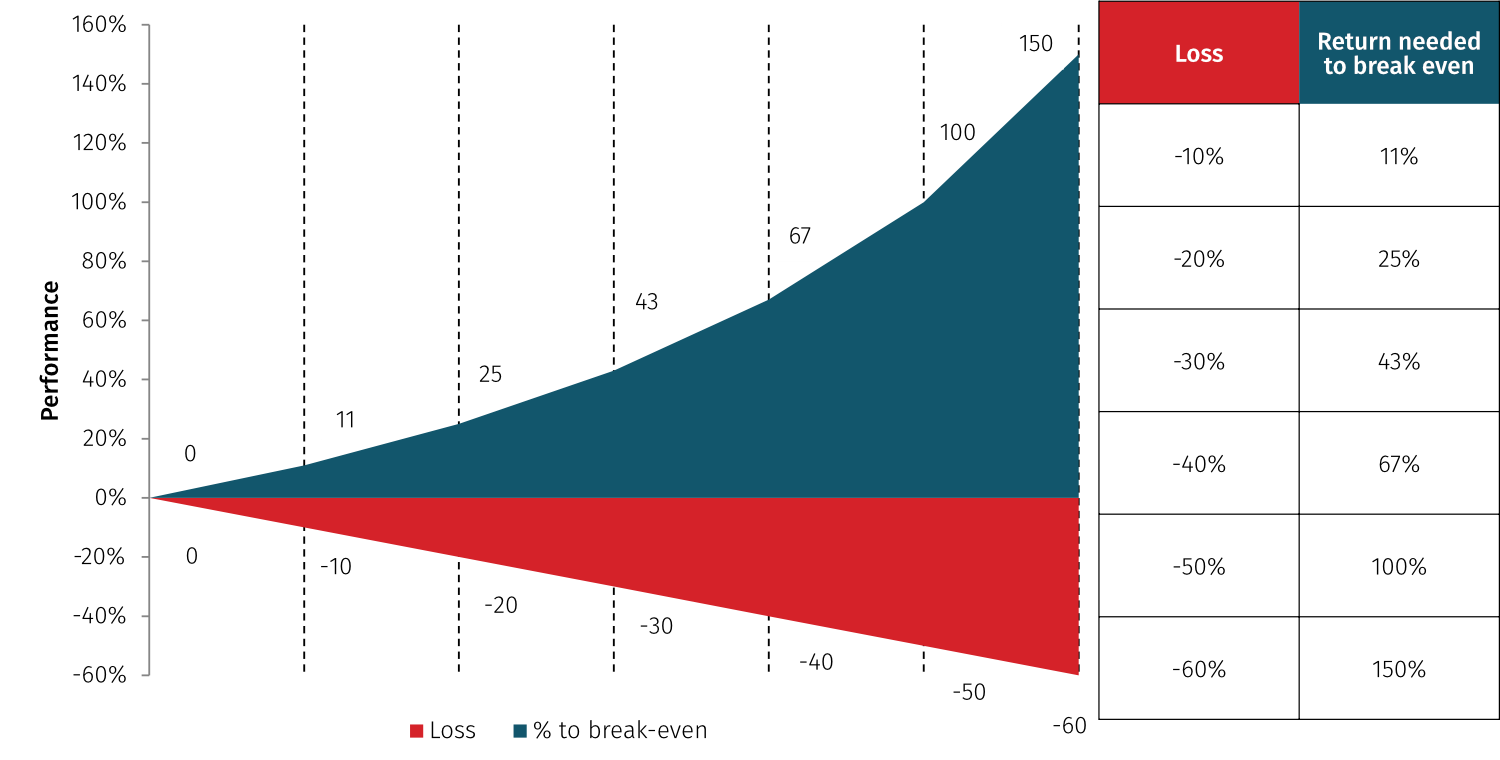

So why is downside protection so important to investors?

To recover from a negative return, a fund needs to make back a greater percentage than was lost, e.g. a loss of 10% requires a gain of 11% to break even. When losses are large, this asymmetry is amplified, e.g. a loss of 50% requires a subsequent gain of 100% to break even.

FIGURE 5: ASYMMETRY OF LOSS

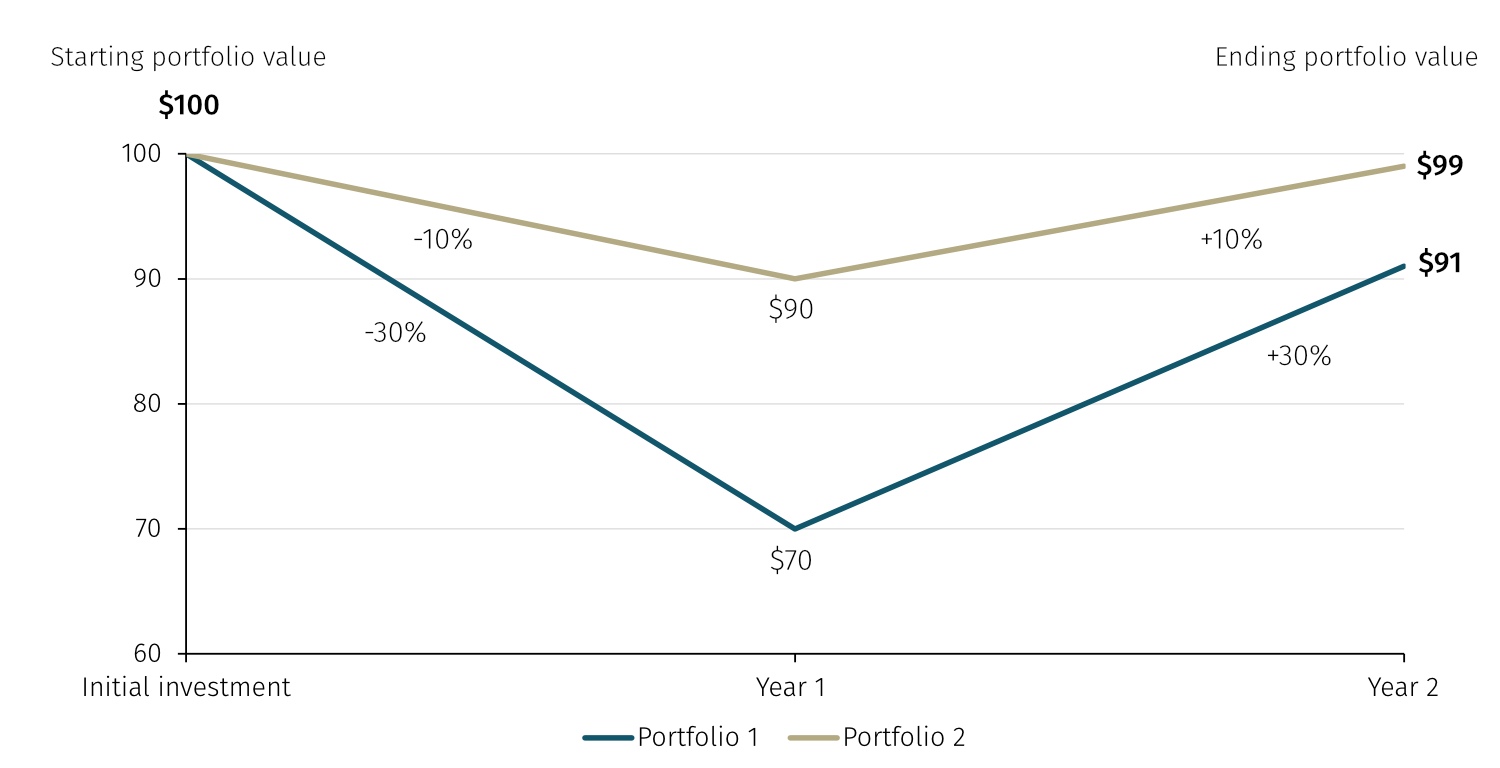

This is why risk adjusted returns are such an important measure for analysing a fund. Two funds can have the same (simple) average return e.g. 0%, however if one achieves it through a journey of year one -30% then year two +30%, and the other achieves it through year one -10% then year two +10%, the outcome on long-term portfolio value of the same average return is very different, as Figure 6 below illustrates.

FIGURE 6: RISK ADJUSTED RETURNS

Hedge funds offer a more consistent return profile than either equities or bonds

When we look back since 2000, hedge funds have generally delivered returns with lower volatility and higher consistency than equities, although with lower average returns. The distribution of bond returns is a more normal distribution just above 0%. The distribution of equity returns is flatter and has “fat tails”, with many more extreme positive and negative months’ returns.

Hedge fund returns are typically higher than bond returns, but with a similar degree of consistency.

FIGURE 7: HEDGE FUND MONTHLY RETURN PROFILE VS SELECTED INDICES

Source: Bloomberg. Hedge funds = HFRI Fund Weighted Composite Index. Feb 1990 – Apr 2022

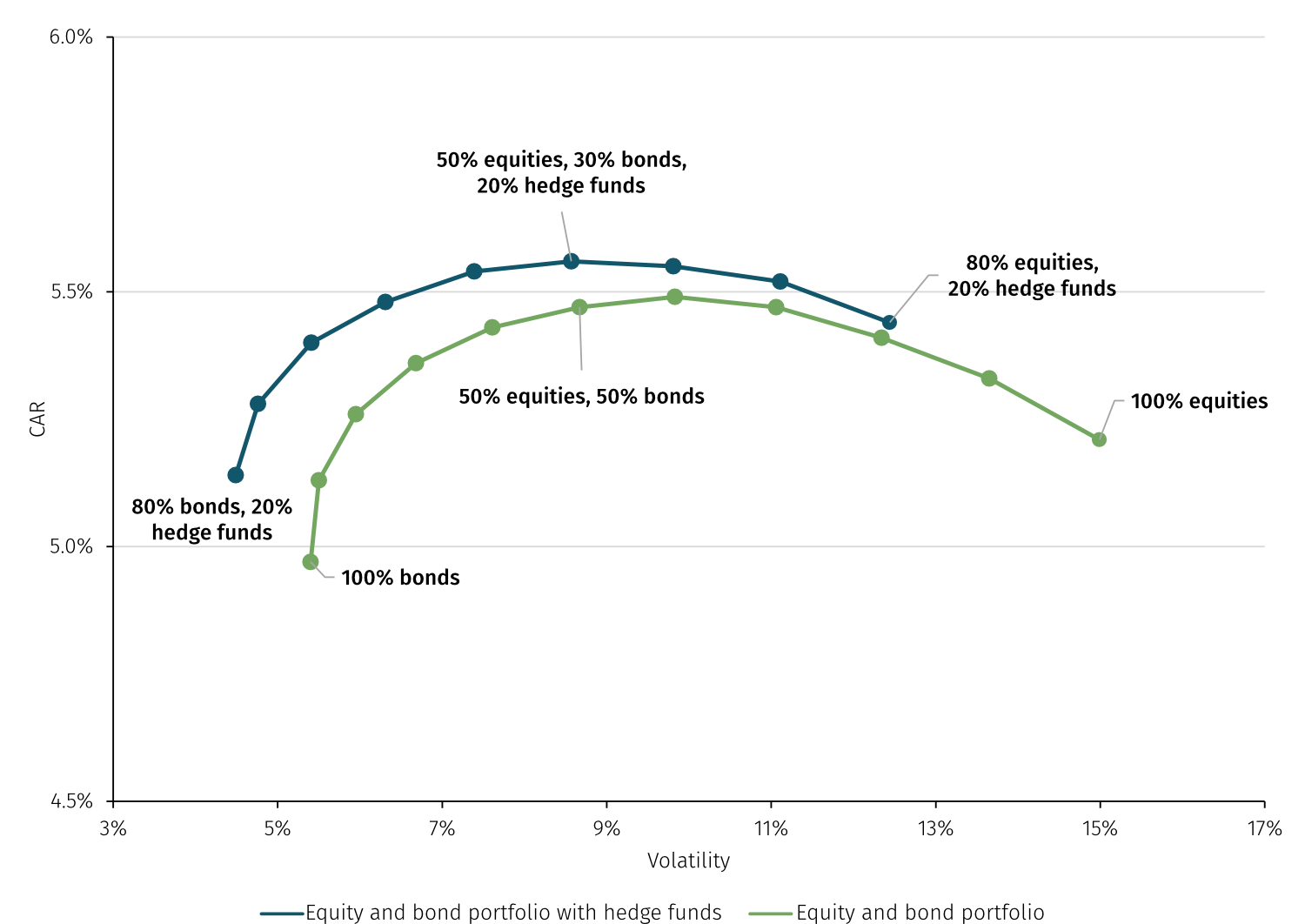

Shift the efficient frontier

As the sections above demonstrate, including an allocation of hedge funds to a portfolio of traditional liquid assets can potentially result in return enhancement and volatility reduction. The efficient frontier represents a set of portfolios that offer the highest return for a set level of risk. Figure 8 below illustrates that when hedge funds are added to portfolios, this shifts the efficient frontier upwards and to the left, representing higher returns for the same level of risk.

FIGURE 8: EFFICIENT FRONTIER WITH HEDGE FUNDS

Source: Aurum Funds Limited Bloomberg, Bonds = Barclays Global Aggregate Bond Index, Equities = MSCI World Index TR, Hedge Funds = HFRI Fund Weighted Composite Index. Performance Period Feb 1990 – May 2022

In part three of the hedge fund basics series, we will look at some of the myths and misconceptions around hedge funds.

Hedge fund basics series

See the full series here

*The Hedge Fund Data Engine is a proprietary database maintained by Aurum Research Limited (“ARL”). For information on index methodology, weighting and composition please refer to https://www.aurum.com/aurum-strategy-engine/. For definitions on how the Strategies and Sub-Strategies are defined please refer to https://www.aurum.com/hedge-fund-strategy-definitions/

Data from the Hedge Fund Data Engine is provided on the following basis: (1) Hedge Fund Data Engine data is provided for informational purposes only; (2) information and data included in the Hedge Fund Data Engine are obtained from various third party sources including Aurum’s own research, regulatory filings, public registers and other data providers and are provided on an “as is” basis; (3) Aurum does not perform any audit or verify the information provided by third parties; (4) Aurum is not responsible for and does not warrant the correctness, accuracy, or reliability of the data in the Hedge Fund Data Engine; (5) any constituents and data points in the Hedge Fund Data Engine may be removed at any time; (6) the completeness of the data may vary in the Hedge Fund Data Engine; (7) Aurum does not warrant that the data in the Hedge Fund Data Engine will be free from any errors, omissions or inaccuracies; (8) the information in the Hedge Fund Data Engine does not constitute an offer or a recommendation to buy or sell any security or financial product or vehicle whatsoever or any type of tax or investment advice or recommendation; (9) past performance is no indication of future results; and (10) Aurum reserves the right to change its Hedge Fund Data Engine methodology at any time and may elect to supress or change underlying data should it be considered optimal for representation and/or accuracy.

Disclaimer

This Post represents the views of the author and their own economic research and analysis. These views do not necessarily reflect the views of Aurum Fund Management Ltd. This Post does not constitute an offer to sell or a solicitation of an offer to buy or an endorsement of any interest in an Aurum Fund or any other fund, or an endorsement for any particular trade, trading strategy or market. This Post is directed at persons having professional experience in matters relating to investments in unregulated collective investment schemes, and should only be used by such persons or investment professionals. Hedge Funds may employ trading methods which risk substantial or complete loss of any amounts invested. The value of your investment and the income you get may go down as well as up. Any performance figures quoted refer to the past and past performance is not a guarantee of future performance or a reliable indicator of future results. Returns may also increase or decrease as a result of currency fluctuations. An investment such as those described in this Post should be regarded as speculative and should not be used as a complete investment programme. This Post is for informational purposes only and not to be relied upon as investment, legal, tax, or financial advice. Whilst the information contained in this Post (including any expression of opinion or forecast) has been obtained from, or is based on, sources believed by Aurum to be reliable, it is not guaranteed as to its accuracy or completeness. This Post is current only at the date it was first published and may no longer be true or complete when viewed by the reader. This Post is provided without obligation on the part of Aurum and its associated companies and on the understanding that any persons who acting upon it or changes their investment position in reliance on it does so entirely at their own risk. In no event will Aurum or any of its associated companies be liable to any person for any direct, indirect, special or consequential damages arising out of any use or reliance on this Post, even if Aurum is expressly advised of the possibility or likelihood of such damages.