Insight

Spotlight on funds of hedge funds: why investors use them

In summary

In the latest instalment of our hedge funds basics series, we look at:

- What are funds of hedge funds?

- Why do some investors choose to access hedge funds via these vehicles?

- The advantages and disadvantages of including funds of hedge funds in a portfolio.

- Fund of hedge fund performance over recent years.

We conclude that investing in a fund of hedge funds can offer investors a solution to overcome some of the barriers to investing in hedge funds.

Direct investment in hedge funds has many barriers to entry. Investing via a fund of hedge funds can save investors from the considerable expense of hiring a hedge fund portfolio management team.

About Aurum

Aurum is an investment management firm focused on selecting hedge funds and managing fund of hedge fund portfolios for some of the world’s most sophisticated investors. Aurum also offers a range of single manager feeder funds.

Aurum’s portfolios are designed to grow and protect clients’ capital, while providing consistent uncorrelated returns. With 30 years of hedge fund investment experience, Aurum’s objective is to lower the barriers to entry enabling investors to access the world’s best hedge funds.

Aurum conducts extensive research and analysis on hedge funds and hedge fund industry trends. This research paper is designed to provide data and insights with the objective of helping investors to better understand hedge funds and their benefits.

What are funds of hedge funds?

A “fund of hedge funds”, sometimes referred to as a “multi-manager fund”, is a fund that invests in a portfolio of other hedge funds.

Funds of hedge funds can vary enormously, but essentially, they give investors exposure to the hedge fund industry through investments in different hedge funds and different hedge fund strategies. By investing with multiple underlying funds and in multiple strategies, a fund of hedge fund has the potential to diversifying away the risk involved in investing with a single manager, fund or strategy.

In reality, funds of hedge funds vary enormously. Funds can be:

- “fettered” (invest funds run by a single underlying manager) or “unfettered” (unrestricted in the hedge fund manager it invests in)

- Concentrated or diversified – some funds may invest only in a single underlying hedge fund, whereas others have a large portfolio of component funds

- Strategy focused or strategy diversified

The fund of hedge fund manager is responsible for:

- Due diligence – conducting both initial and ongoing due diligence on the underlying funds and their managers, and consequent hiring and firing decisions

- Portfolio management – weighting the funds and strategies in the portfolio to achieve the targeted return within acceptable volatility parameters

- Reporting to the investors in the fund of hedge fund

Problems funds of hedge funds may solve

Direct investing in hedge funds typically has many barriers to entry, which funds of hedge funds may help to overcome:

- Hedge funds and their associated strategies are usually complex and therefore require specialist knowledge.

- Hedge fund performance can be wildly divergent, across both strategies and funds, making fund selection challenging.

- The most sought-after hedge funds often have very high minimum investment amounts, onerous liquidity terms, and may be hard closed to new investment, which can prevent many investors from accessing them directly.

- Access to the most in demand new launches often requires a network of connections and the resources and expertise to perform due diligence on funds.

What are the advantages and disadvantages of including funds of hedge funds in your portfolio?

Advantages

It is widely recognised that hedge funds themselves do not represent a low-cost investment option and of course investing via a fund of hedge funds introduces additional fees. However, another way of looking at these additional fees is that investing via a fund of hedge funds offsets the considerable expense of hiring a hedge fund portfolio management team and provides industry expertise and experience. So, these fees could both represent a cost saving and improve returns for some investors. Below we consider what these fees cover.

Relationships and networks

The hedge fund industry is vast. Aurum’s Hedge Fund Data Engine[1] tracks the performance of approximately 3,500 active hedge funds worldwide with around $3 trillion in assets at June 2023. In an industry of this size and complexity, it is very difficult for even professional investors with a dedicated hedge fund analyst to monitor and perform due diligence on funds.

Performance varies hugely across the hedge fund industry and identifying the funds with the potential to outperform can be challenging.

High quality fund of hedge funds managers typically have experienced employees and long-standing relationships and networks in the hedge fund industry. They should therefore be better positioned to identify the best emerging funds and to avoid weaker funds.

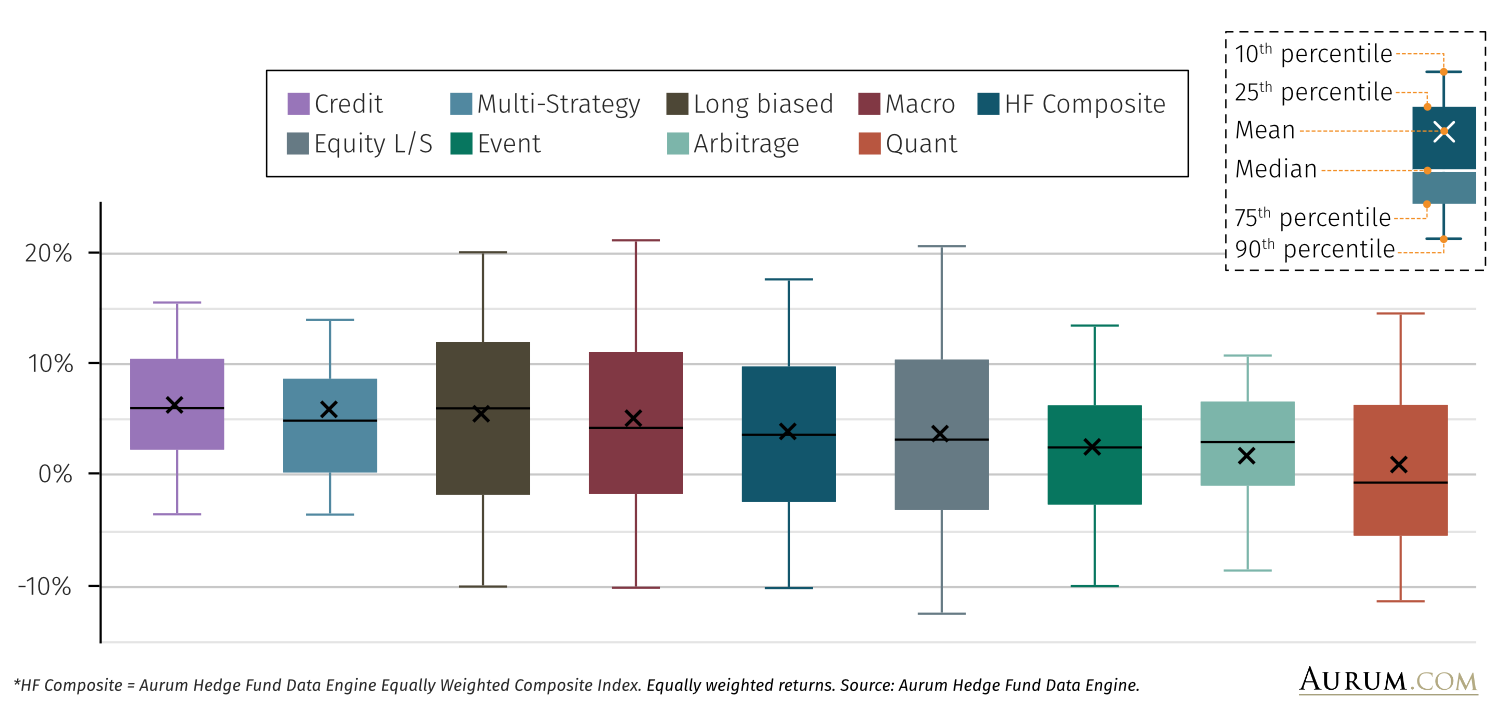

Performance varies hugely across the hedge fund industry and identifying the funds with the potential to outperform can be challenging. This is illustrated in the chart below which shows the breadth of hedge fund industry performance dispersion over a 12-month period to October 2023.

FIGURE 1: HEDGE FUND INDUSTRY PERFORMANCE DISPERSION BY STRATEGY, 12 MONTHS TO OCTOBER 2023

For more data on hedge fund industry performance and dispersion data, see Aurum’s live hedge fund data here: https://www.aurum.com/hedge-fund-data/industry-performance/hedge-fund-performance-by-strategy-latest-data/

Another benefit of investing through funds of hedge funds is that they may have the contacts and relationships to access new launches that spin out from large funds, which may be closed to new investment.

Due diligence – sourcing

Researching and identifying potential funds for investment requires not only skill and knowledge, but access to information and data.

Initial due diligence expenses typically include hedge fund database subscriptions, independent research reports, and background checks.

Before all this though, a major expense is having suitable staff to perform these functions. Costs associated with this include job-searches for experienced personnel, the ongoing costs of paying staff, of training them, of undertaking professional qualifications and attending industry events to maintain their skills and knowledge.

These components of the investment due diligence process combine to make creating a diversified portfolio of hedge funds both time consuming and expensive.

Due diligence – cost

Researching, investing in, and monitoring a diversified portfolio of hedge funds can be a costly endeavour. Depending on the size of the investment, the complexity of the strategies, and the number of funds to be analysed and monitored.

The costs associated with pursuing a diversified hedge fund portfolio could range from hundreds of thousands to millions of dollars.

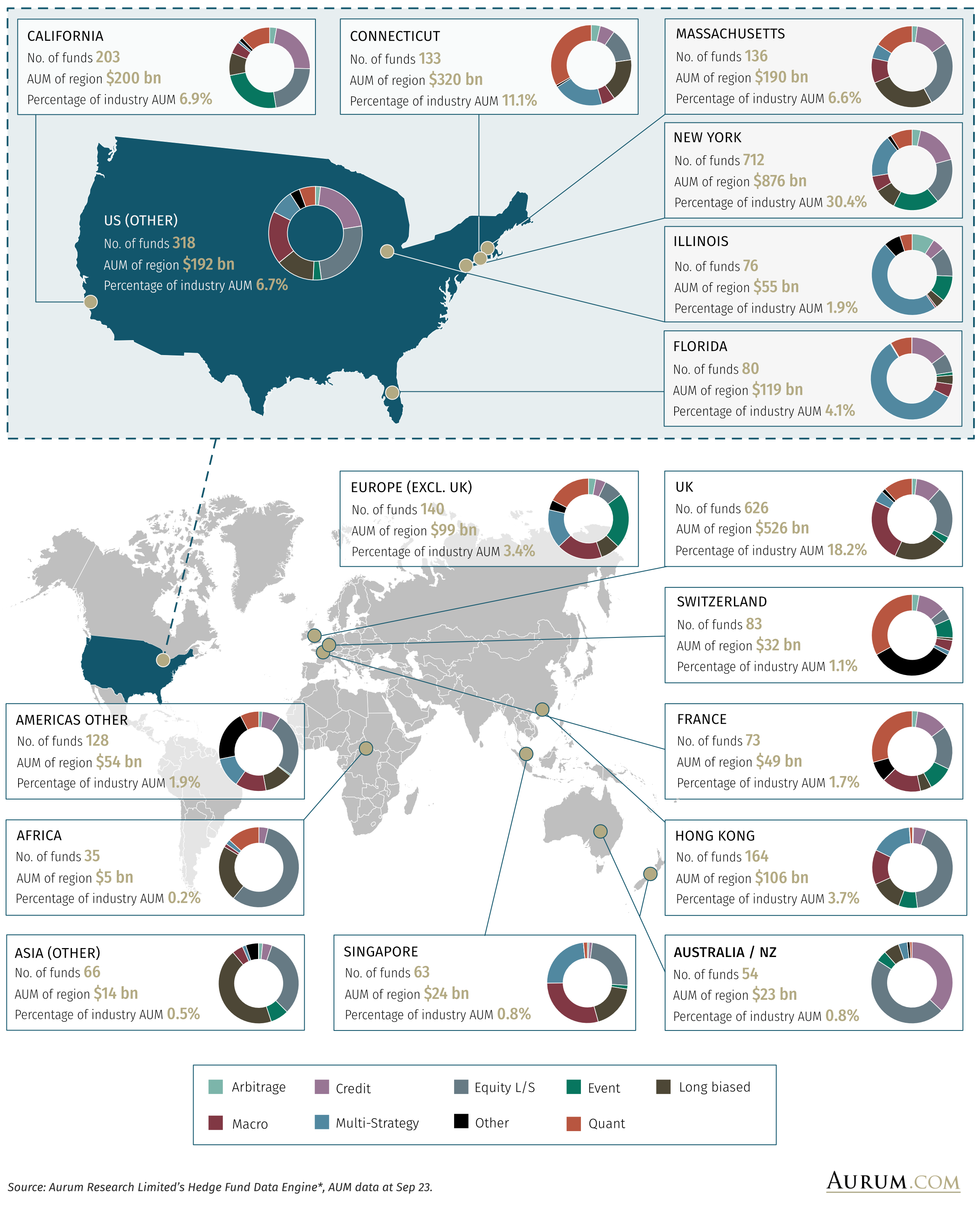

Investing in hedge funds is a truly global business. The chart below illustrates the regions where hedge fund investment managers are based (focusing on the largest regions by assets managed, which span the globe).

FIGURE 2: GLOBAL HEDGE FUND INDUSTRY BY REGION

Certain regions appear to favour particular investment strategies. For example, the UK is a hub for macro funds, with over 40% of macro assets managed from the UK, while New York and Chicago have historically been centres for multi-strategy funds.

Constructing a high-quality portfolio of hedge funds that is diversified by underlying strategy is a global endeavour, requiring regular international travel, which can be expensive. Investing through a fund of hedge funds can reduce these costs by making use of economies of scale.

Due diligence – expertise and experience

Due diligence is not only essential at the outset of an investment – it is an ongoing responsibility during the lifetime of an investment. Investment due diligence requires the monitoring a fund’s performance, the execution of the strategy, and the quality of management.

Hedge funds are operationally complex. Assessing the operational risk in a hedge fund investment requires analysis of multiple counterparties, service providers, IT infrastructure, back office, and accounting systems, and whether the fund’s terms, legal structure, and transparency levels are appropriate for its strategy.

Both investment and operational due diligence are highly specialised tasks that take expertise and time. Good funds of hedge funds bring expertise and experience to hedge fund analysis, supported by an organisational structure that has robust risk control systems and operational due diligence experts.

Access

Many of the most sought-after hedge funds are closed to new investors. Funds of hedge funds often have long-standing relationships with hedge fund managers. An investment in a fund of hedge funds can provide exposure to hard closed funds. Funds of hedge funds may also be able to secure capacity for new investments in otherwise closed funds. This may be because underlying funds may prefer to offer additional capacity to existing investors who have already undertaken due diligence rather than entering into a new relationship and starting the due diligence process from scratch. Underlying funds may also have contractual agreements in place which give certain existing investors, such as fund of hedge funds, access to a specified amount of capacity.

Diversification

Hedge funds vary enormously, not only by strategy, but also by how the strategy is executed by different managers. A diversified portfolio of hedge funds can generate a truly uncorrelated return stream. However, a diversified portfolio of hedge funds, typically requires a very large capital outlay, due to the high minimum investment amounts of many hedge funds. Good quality, diversified funds of hedge funds offer the benefits of a portfolio of hedge fund investments, with a significantly lower minimum investment amount.

Economies of scale

By pooling the investments of multiple underlying investors, funds of hedge funds may give smaller investors access to cheaper share classes which have minimum investment amounts that are targeted at larger, institutional investors.

Disadvantages

Fees

Funds of hedge funds typically charge an additional layer of fees. In addition to the fees charged by the underlying hedge funds, funds of hedge funds add an extra layer of management and/or performance fees, which can reduce returns compared to investing directly in the same underlying hedge funds. However, the additional fees may be mitigated if the fund of hedge funds has secured preferential terms or otherwise invests in share classes with lower fees than what may be available to some other investors.

Performance dispersion

As with any direct investment in hedge funds, when investing in a fund of hedge funds, manager selection can be challenging, though is critical for a successful outcome.

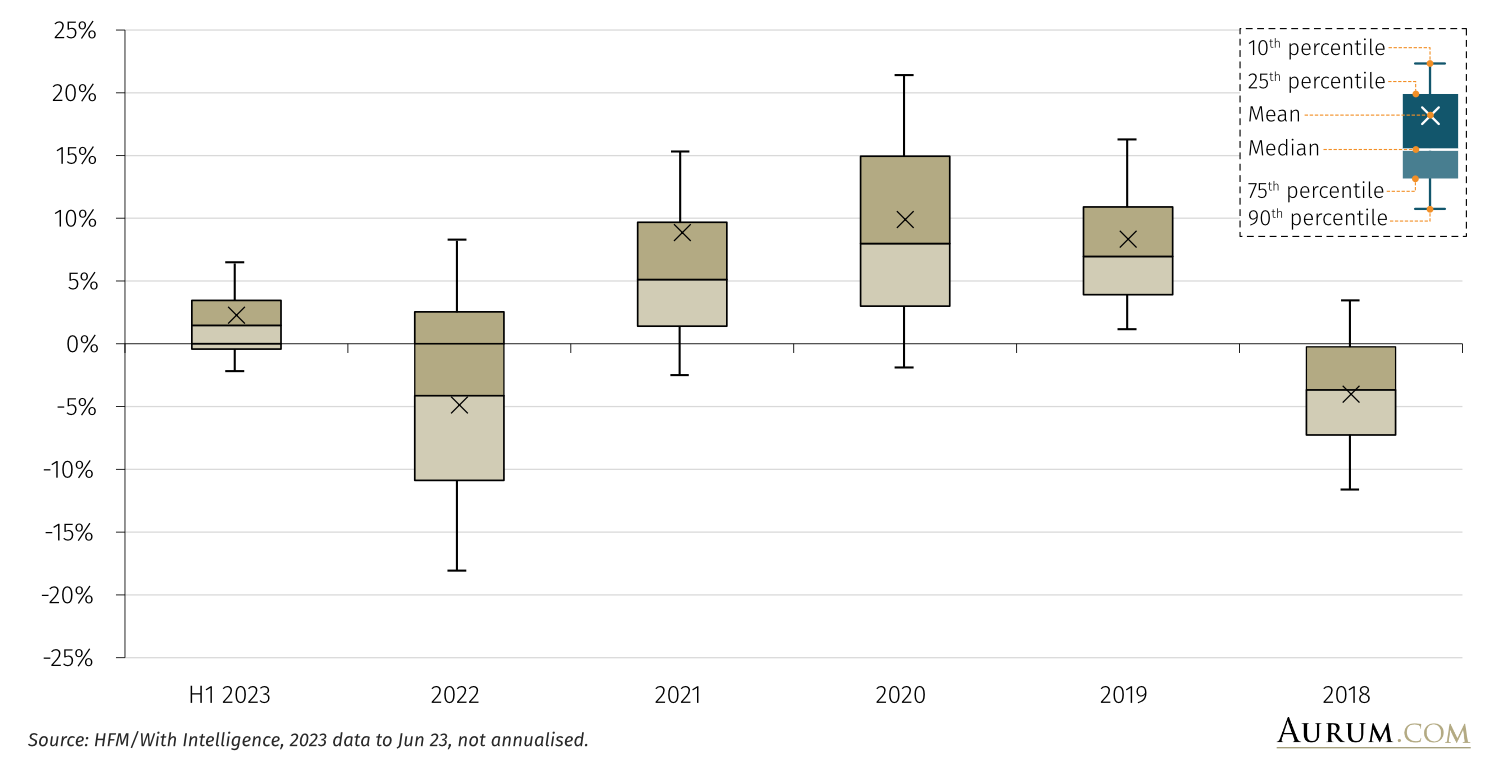

The chart below looks at the dispersion in fund of hedge fund performance over the past five years based on data provided by HFM/With Intelligence. Jefferies estimates the size of the fund of hedge fund industry in 2021 at around $800 bn[2]. At June 2023, the HFM/With Intelligence database tracked the performance of just over $113 bn fund of hedge fund assets. Although only approximately 14% of fund of hedge funds industry assets are represented in the HFM/With Intelligence data, there are enough constituents within the index to facilitate illustrative observations.

2022 was notable for the particularly broad net performance dispersion, with an over 26% spread between the 90th percentile return (-18.1%) and the 10th percentile return (8.3%).

FIGURE 3: FUND OF HEDGE FUNDS- PERFORMANCE DISPERSION

Strategy selection limitations

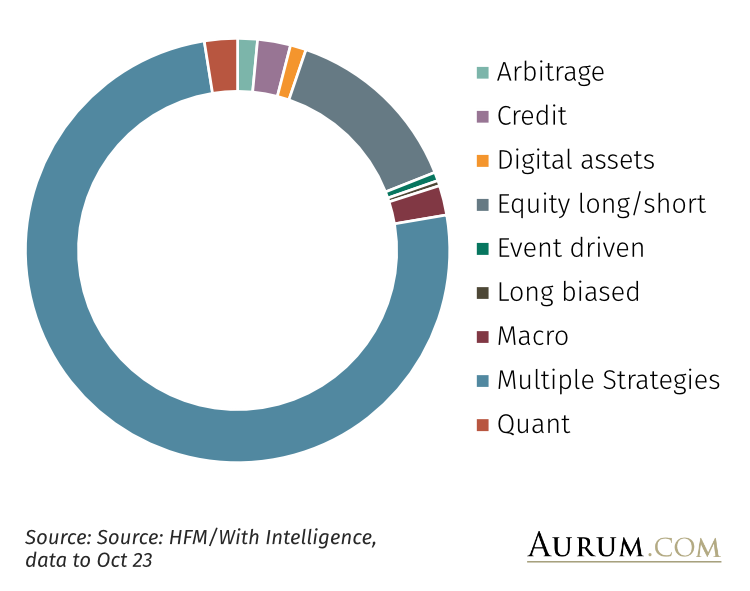

The chart below, based on data provided by HFM/With Intelligence, illustrates the strategy composition of the fund of hedge funds industry, by the number of funds.

FIGURE 4: FUND OF HEDGE FUND INDUSTRY STRATEGY SPLIT

Investors need to choose funds of hedge funds with strategies that are best placed to support their investment objectives. The majority (three quarters according to the HFM data) of the fund of hedge fund industry is made up of funds with multiple underlying strategies. Some of these funds of hedge funds invest in underlying multi-strategy hedge funds, but many invest in a range of specific single strategies, offering investors access to a diversified portfolio of hedge fund strategies.

Around 25% of the fund of hedge fund industry consists of funds that invest into a single underlying hedge fund strategy. It is important to recognise that accessing hedge funds through single strategy fund of hedge funds is unlikely to offer the diversification benefits that investing into multiple, uncorrelated, strategies may bring.

Over 15% of funds of hedge funds invest solely in strategies which have historically exhibited a high beta to equities. These higher-beta strategies may also be significantly represented in funds which invest in multiple strategies. Investments in these funds may afford investors limited protection during periods of stress for traditional assets, which likely explains the particularly large dispersion in returns for funds of hedge funds during 2022, a year marked by large sell-offs in risk assets.

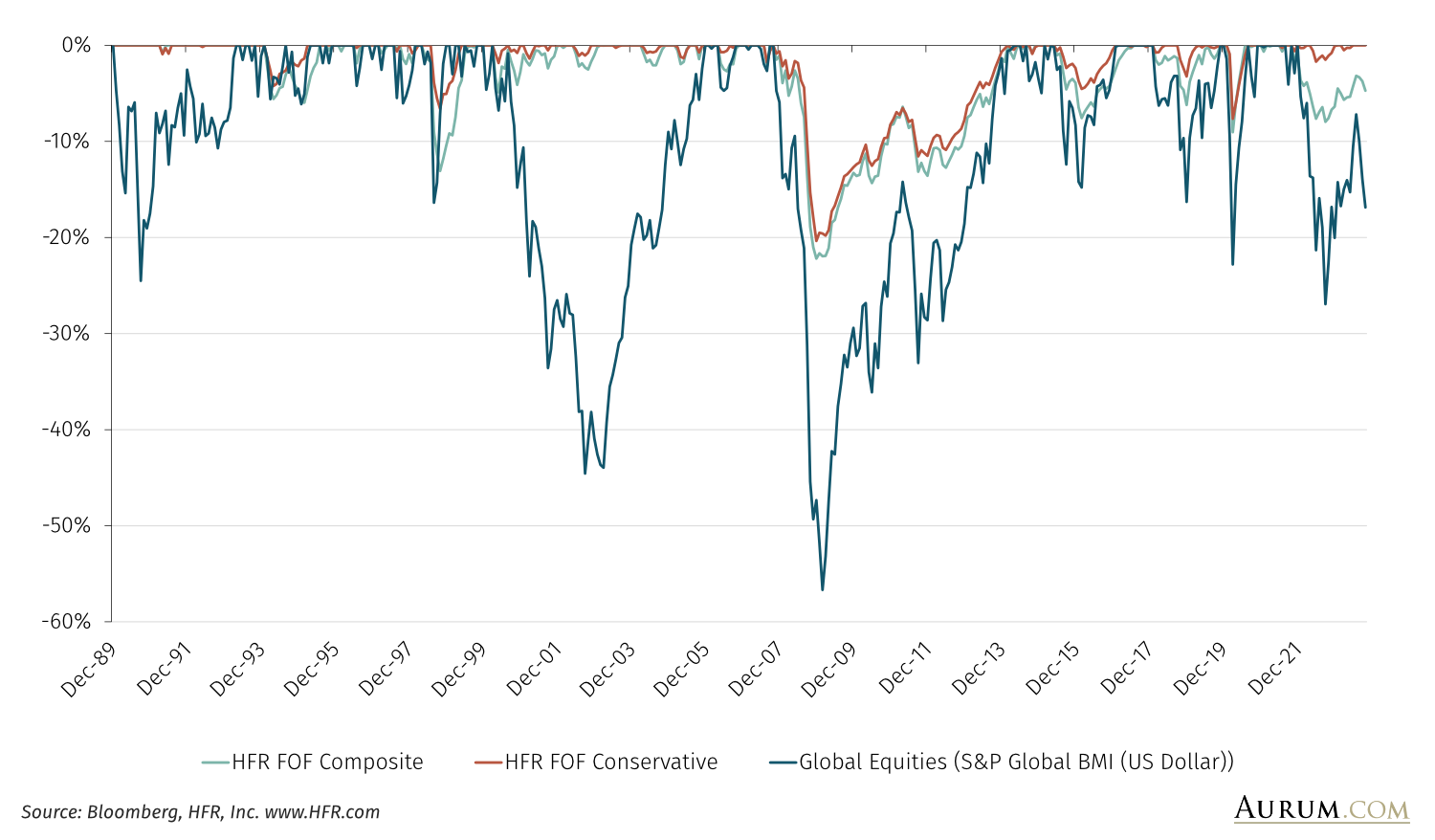

This can be demonstrated over the longer-term in the chart below, which shows the difference between the HFR FOF Conservative Index[2] and the HFR FOF Composite Index[2], the latter of which has exhibited a higher correlation to equities. The HFR FOF Conservative Index (the more conservative index which typically has lower exposure to higher beta hedge fund strategies) has, over the period, experienced less severe drawdowns and faster recoveries during periods of equity market volatility.

FIGURE 5: UNDERWATER DRAWDOWN

Conclusion

Funds of hedge funds offer a broader group of investors the opportunity to access the potential benefits of hedge funds, including:

- Uncorrelated returns

- Protection of capital in volatile markets – avoiding losses

- Reduced portfolio volatility

- Increased consistency of positive returns

Funds of funds may also enable investors to:

- Gain exposure to sought-after hard closed hedge funds

- Access cheaper share classes by pooling investments, which allows access to share classes targeted at larger investors.

- Leverage existing relationships in the hedge fund industry to gain exposure to high quality newly launched funds.

- Benefit from the reassurance of high-quality due diligence performed on investments.

There is a high dispersion of returns across fund of hedge funds and many of the funds have large allocations to beta-exposed strategies. As with all hedge fund investments, manager selection is critical for investors to meet their investment objectives.

The best funds of hedge funds offer investors the opportunity to achieve high quality hedge fund returns and overcome barriers to entry, relieving the burden and cost of initial and ongoing due diligence and monitoring.

Hedge fund basics series

See the full series here

-

HFRI FOF: Conservative Index: FOFs classified as ‘Conservative’ exhibit one or more of the following characteristics: seeks consistent returns by primarily investing in funds that generally engage in more ‘conservative’ strategies such as Equity Market Neutral, Fixed Income Arbitrage, and Convertible Arbitrage; exhibits a lower historical annual standard deviation than the HFRI Fund of Funds Composite Index. A fund in the HFRI FOF Conservative Index shows generally consistent performance regardless of market conditions.

HFR FOF Composite is a broad index of fund of funds – which Hedge Fund Research, the index provider, defines as products which invest with multiple managers through funds or managed accounts. https://www.hfr.com/hfri-indices-index-descriptions#:~:text=HFRI%20Fund%20Weighted%20Composite%20Index,that%20report%20to%20HFR%20Database.

-

Source: https://primeservices.jefferies.com/wp-content/uploads/sites/2/2023/01/JEFEvolutionofFundofFunds.pdf

*The Hedge Fund Data Engine is a proprietary database maintained by Aurum Research Limited (“ARL”). For information on index methodology, weighting and composition please refer to https://www.aurum.com/aurum-strategy-engine/. For definitions on how the Strategies and Sub-Strategies are defined please refer to https://www.aurum.com/hedge-fund-strategy-definitions/

Data from the Hedge Fund Data Engine is provided on the following basis: (1) Hedge Fund Data Engine data is provided for informational purposes only; (2) information and data included in the Hedge Fund Data Engine are obtained from various third party sources including Aurum’s own research, regulatory filings, public registers and other data providers and are provided on an “as is” basis; (3) Aurum does not perform any audit or verify the information provided by third parties; (4) Aurum is not responsible for and does not warrant the correctness, accuracy, or reliability of the data in the Hedge Fund Data Engine; (5) any constituents and data points in the Hedge Fund Data Engine may be removed at any time; (6) the completeness of the data may vary in the Hedge Fund Data Engine; (7) Aurum does not warrant that the data in the Hedge Fund Data Engine will be free from any errors, omissions or inaccuracies; (8) the information in the Hedge Fund Data Engine does not constitute an offer or a recommendation to buy or sell any security or financial product or vehicle whatsoever or any type of tax or investment advice or recommendation; (9) past performance is no indication of future results; and (10) Aurum reserves the right to change its Hedge Fund Data Engine methodology at any time and may elect to supress or change underlying data should it be considered optimal for representation and/or accuracy.

Disclaimer

This Post represents the views of the author and their own economic research and analysis. These views do not necessarily reflect the views of Aurum Fund Management Ltd. This Post does not constitute an offer to sell or a solicitation of an offer to buy or an endorsement of any interest in an Aurum Fund or any other fund, or an endorsement for any particular trade, trading strategy or market. This Post is directed at persons having professional experience in matters relating to investments in unregulated collective investment schemes, and should only be used by such persons or investment professionals. Hedge Funds may employ trading methods which risk substantial or complete loss of any amounts invested. The value of your investment and the income you get may go down as well as up. Any performance figures quoted refer to the past and past performance is not a guarantee of future performance or a reliable indicator of future results. Returns may also increase or decrease as a result of currency fluctuations. An investment such as those described in this Post should be regarded as speculative and should not be used as a complete investment programme. This Post is for informational purposes only and not to be relied upon as investment, legal, tax, or financial advice. Whilst the information contained in this Post (including any expression of opinion or forecast) has been obtained from, or is based on, sources believed by Aurum to be reliable, it is not guaranteed as to its accuracy or completeness. This Post is current only at the date it was first published and may no longer be true or complete when viewed by the reader. This Post is provided without obligation on the part of Aurum and its associated companies and on the understanding that any persons who acting upon it or changes their investment position in reliance on it does so entirely at their own risk. In no event will Aurum or any of its associated companies be liable to any person for any direct, indirect, special or consequential damages arising out of any use or reliance on this Post, even if Aurum is expressly advised of the possibility or likelihood of such damages.