Hedge fund performance – explore our live data to June 2024

June 2024

Hedge fund performance was broadly positive in June. Strategies with a higher beta to equities performed well in another risk-on month. The best performing strategy was multi-strategy. The weakest performing strategy was macro.

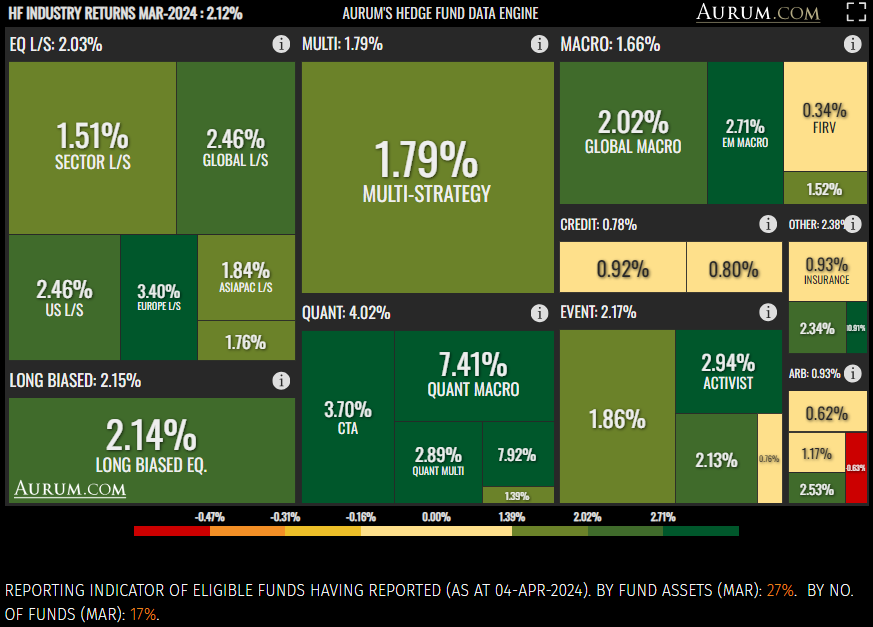

Hedge fund performance by strategy – June 2024

(asset weighted)

How to navigate the treemap

You can drill down further into the data to see key stats and 12 months’ performance dispersion data for each sub-strategy. Click on the strategy you are interested in and you can then click through further into any sub-strategy of interest.

The size of the boxes indicates the proportionate size of a strategy amongst all of the funds monitored by Aurum’s Hedge Fund Data Engine.

To navigate back you can just scroll back on the mouse wheel or click the magnifying glass with the minus button, which can be found in the top right corner of each box.

Want to share our charts? We are happy for you to do so, but please do quote the source: Aurum Research Limited’s Hedge Fund Data Engine

Source: Aurum’s proprietary Hedge Fund Data Engine database containing data on around 3,400 active hedge funds representing around $3.0 trillion of assets as at June 2024. Information in the database is derived from multiple sources including Aurum’s own research, regulatory filings, public registers and other database providers. Performance is asset weighted. Box size reflects the AUM of the hedge fund industry, as tracked by Aurum. See the disclaimer and strategy definition for further details. This webpage and its contents do not constitute an offer to sell or a solicitation of an offer to buy or endorsement of any interest in any hedge fund strategy. An investment in a hedge fund should be considered a speculative investment. Past performance is no guarantee of future returns.

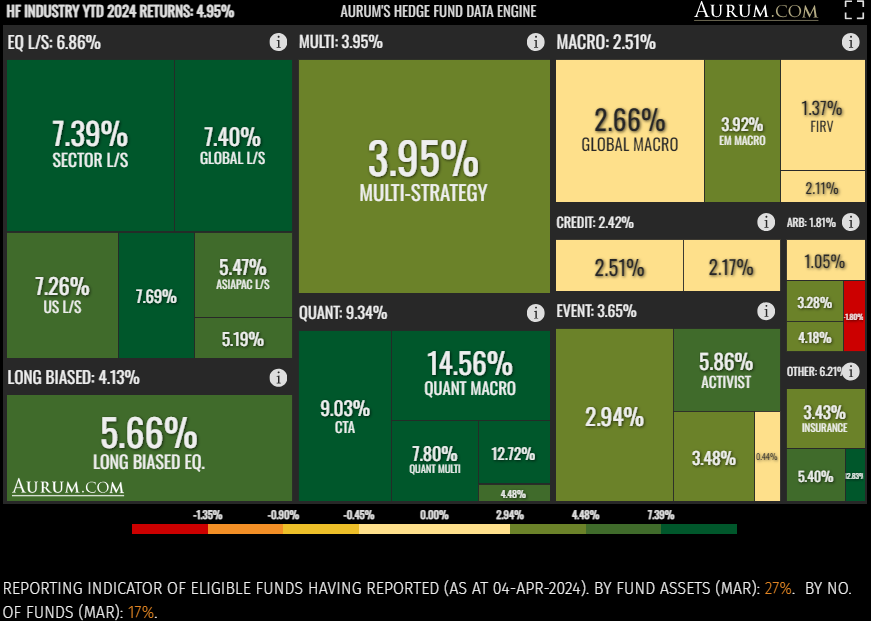

Hedge fund performance by strategy – year to date

(asset weighted)

How to navigate the treemap

You can drill down further into the data to see key stats and 12 months’ performance dispersion data for each sub-strategy. Click on the strategy you are interested in and you can then click through further into any sub-strategy of interest.

The size of the boxes indicates the proportionate size of a strategy amongst all of the funds monitored by Aurum’s Hedge Fund Data Engine.

To navigate back you can just scroll back on the mouse wheel or click the magnifying glass with the minus button, which can be found in the top right corner of each box.

Source: Aurum’s proprietary Hedge Fund Data Engine database containing data on around 3,400 active hedge funds representing around $3.0 trillion of assets as at June 2024. Information in the database is derived from multiple sources including Aurum’s own research, regulatory filings, public registers and other database providers. Performance is asset weighted. Box size reflects the AUM of the hedge fund industry, as tracked by Aurum. See the disclaimer and strategy definition for further details. This webpage and its contents do not constitute an offer to sell or a solicitation of an offer to buy or endorsement of any interest in any hedge fund strategy. An investment in a hedge fund should be considered a speculative investment. Past performance is no guarantee of future returns.

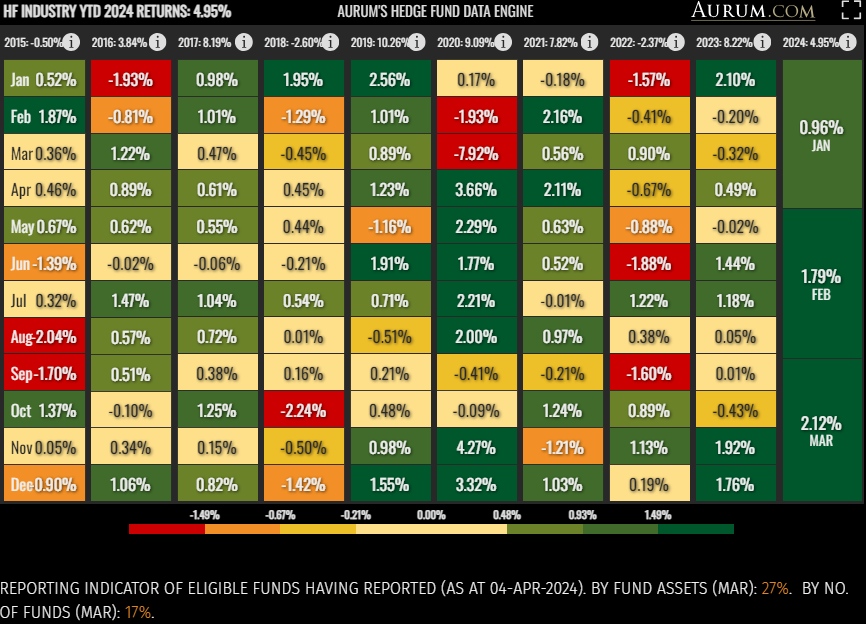

Hedge fund performance from 2015 – June 2024

How to navigate the treemap

To navigate back you can just scroll back on the mouse wheel or click the magnifying glass with the minus button, which can be found in the top right corner of each box.

Want to share our charts? We are happy for you to do so, but please do quote the source: Aurum Research Limited’s Hedge Fund Data Engine

Source: Aurum’s proprietary Hedge Fund Data Engine database containing data on around 3,400 active hedge funds representing around $3.0 trillion of assets as at June 2024. Information in the database is derived from multiple sources including Aurum’s own research, regulatory filing, public registers and other database providers. Performance is asset weighted. Box size reflects the AUM of the hedge fund industry, as tracked by Aurum. See the disclaimer and strategy definition for further details. This webpage and its contents do not constitute an offer to sell or a solicitation of an offer to buy or endorsement of any interest in any hedge fund strategy. An investment in a hedge fund should be considered a speculative investment. Past performance is no guarantee of future returns.

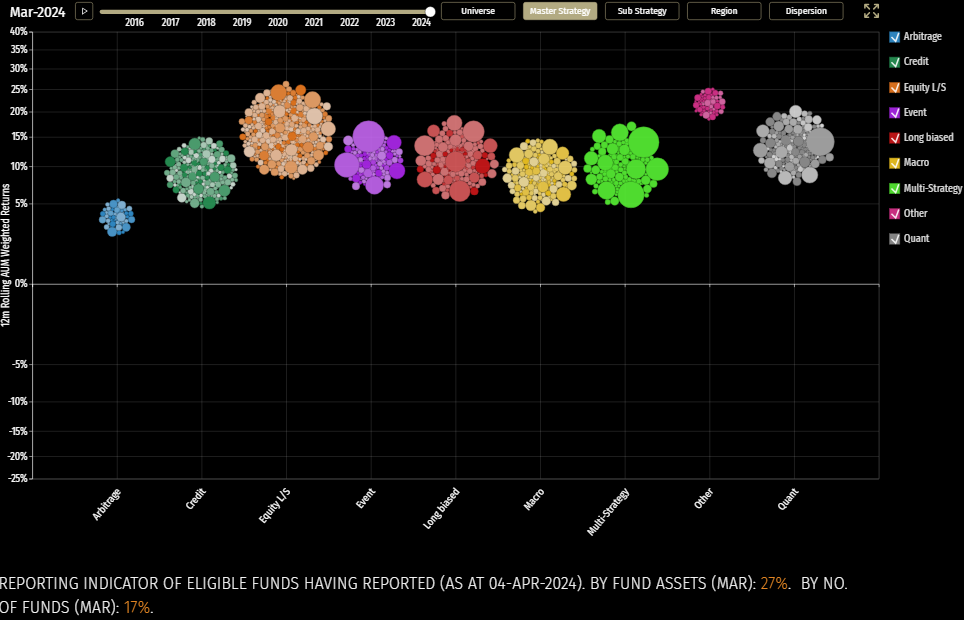

Hedge fund performance by strategy – June 2024

(asset weighted)

Notes to chart

Bubble size is proportionate to reported fund AUM.

Colours represent strategy groupings.

The vertical mid-point position of the groups indicate the 12-month rolling AUM weighted average performance of the funds in that group. Note; this figure includes funds with AUM <$500m, these do not appear as bubbles simply to improve graphical performance.

Hover over a group or X Axis label for more information on strategy AUM, profit, net flows, returns and number of funds in the group.

The Dispersion chart y-axis has been set to a static -60% to +60% range. Any outlier funds with rolling 12m performance outside of this range are not reflected.